If you ever want to access a loan in the future, you must read this blog.

Australia has introduced a new Comprehensive Credit Rating System. On 2nd November 2017, the Government announced that it would legislate a mandatory comprehensive credit reporting regime to effect by 1st July 2018, requiring the four big banks to participate fully in the credit reporting system.

Under this new system, lenders can now access your creditworthiness will be scored against a maximum of 1,200. Unlike in the earlier system, where only negative information (delayed repayments for more than 60 days, bankruptcies, etc.) were recorded, the new system will provide far more information – monthly payment histories on loans and credit cards (with red flags on any missed payments of more than 14 days) with data going back to 2 years.

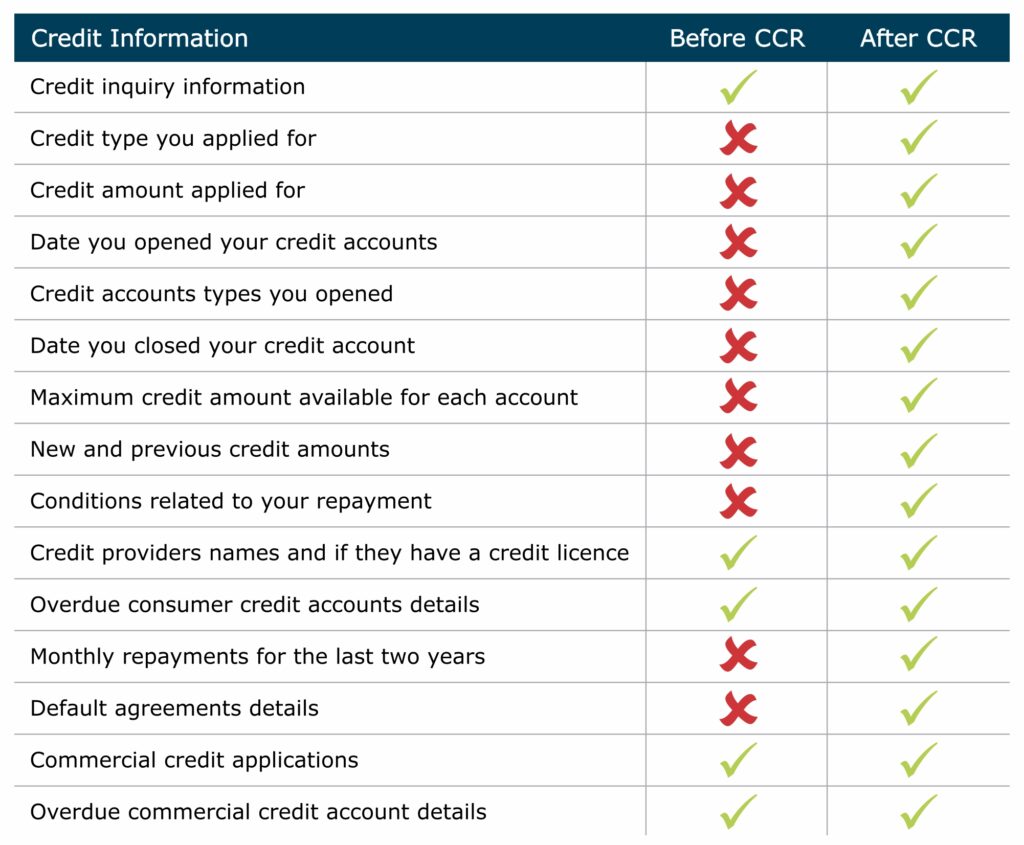

The table below provides a summary of some of the information now accessible to the lenders under the Comprehensive Credit Rating (CCR) regime:

Source: https://www.finder.com.au/comprehensive-credit-reporting

There are 4 main credit rating agencies that provide this service: Equifax, Experian, Dun & Bradstreet (Tasmanian collection in Tasmania).

Some reports estimate that around 40% of the decisions about credit applications will change compared with the current system (where only negative information is shared).

What can impact your credit score?

- Payment History: One of the most critical components of your credit score. Even one missed payment could have a significant impact on your score.

- Credit Utilisation: This factor assesses your dependence on non-cash funds. Computed by dividing the total revolving credit you use by the total revolving credit available. Generally, utilising more than 30% of your available credit may not be viewed favourably.

- Credit Mix: People with a higher credit score have a diverse portfolio of credit accounts. Credit scoring considers the types of accounts and how many of each you have. They consider your past debt experiences and how you have handled them, i.e., your ability to pay back debt.

- Credit History Age: How long have you had your oldest credit account? Longer history demonstrates you have a lot of experience handling credit and is viewed positively.

- Hard Inquires: Every time a bank requests for your credit rating score, this inquiry is recorded on your file and retained for up to 2 years. Sometimes this can have a negative impact on your score (too many inquiries in a short period).

- Negative Information: Late or missed payments, foreclosures, collection accounts and charge-offs are all negative information that appears on your credit file. These stay up to 7 years in your file so best to avoid any negative infractions.

What does not impact your Credit Score?

Your credit score is not impacted by your income, bank balances, age, employment status, marital status, debit card usage, etc. Some of these may impact your ability to get a loan approved but they are not factored into your Credit Score.

How can you improve your Credit Score?

- Avoid missing a repayment.

- Avoid maxing out your credit limit.

- Do not apply for balance transfers too often.

- Reconsider closing your credit cards that have a good repayment.

- Do not apply for several loans/credit cards etc.

- Do not change your lenders too frequently.

- Apply to correct any inaccurate information in your credit report.

Given that from 1st July 2019, banks will have to share 100% of the data with the rating agencies, it is well worth to keep the above in mind. One key thing to do if you are considering borrowing could be to obtain your credit report to assess how you fare and if there are actions that need to be taken to improve your score to increase chances of you securing that loan.

Niyati Khanna (CFP Professional, Chartered Accountant [ICAI], MBA [Finance & Strategy]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.