Are you thinking of starting a Self-Managed Super Fund (SMSF), or maybe you already have one?

Wouldn’t it be fantastic to be in charge of your own superannuation money… You get to make the investment decisions, you’re held responsible for complying with super and tax laws, and you pay for this privilege in your own time and money (and potentially a lot of it!). Starting to sound a little more complex? Well, that’s because it is.

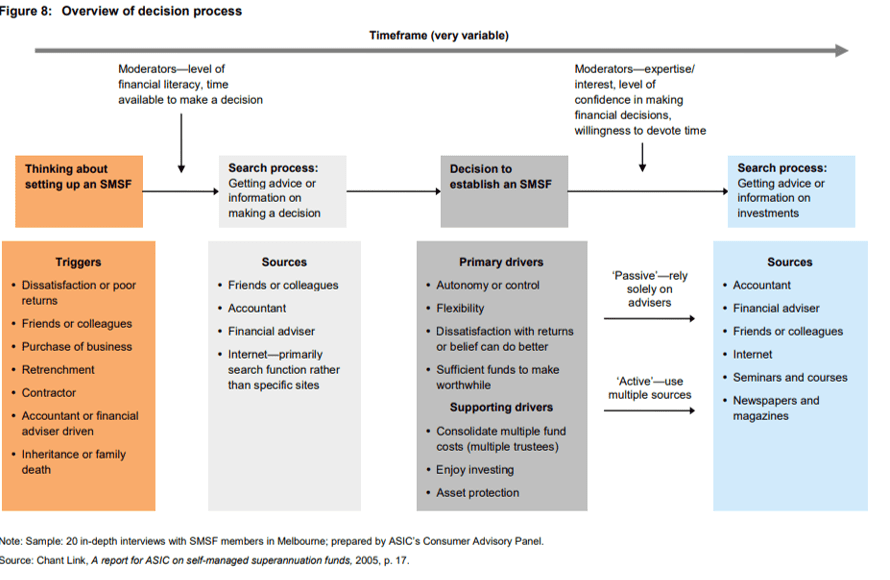

A decision to commence an SMSF should not be taken lightly, and you will need to understand if it is appropriate for you based on your individual circumstances, your goals, and your objectives.

In a 2019 press release, ASIC urged investors to question whether SMSFs are right for their superannuation needs – so let’s dive into some of the key considerations:

Superannuation Investment Decisions

Are you an investment expert… really?

- What is your investment philosophy?

- How will you invest? What is your strategy?

- What’s your level of risk?

- Can you control your costs and manage your time?

- Are you sufficiently diversified?

Compliance, Compliance, Compliance

There are many duties and responsibilities which are serious and broad in nature.

- Are you literate in superannuation and tax laws?

- If not, are you willing to find experts to review this on your behalf?

- As trustee/s of your SMSF, do you understand the consequences of getting this wrong? Even if you outsource to professionals, the responsibilities remain with you.

Time

ASIC’s research from 2019 confirmed on average an SMSF trustee spends more than 100 hours a year managing their SMSF.

- Do you have ample time to allocate to the management of your SMSF?

Cost

In 2016, the average annual cost of running an SMSF was $13,700 (Self-managed super funds: a statistical overview 2015–2016) – is it worth it?

- Accountant fees – these are upfront, ongoing, and when winding down

- Audit fees

- Legal advice fees

- Financial advice fees

- Investment, management, and administration fees

- ‘Opportunity’ cost?

The question you should be asking yourself when making a sound financial decision (or any life decision for that matter) is, what is the ‘opportunity cost’? A dollar can only be spent once, so spend it wisely. You should be fully informed in your decision-making process of what alternatives are available, which may in fact be more effective to assist you in reaching your retirement goals and objectives.

If you would like to know more, get in touch.

Kelsey Dent (DipFP, ADFP, BA Hons [Bus,Mgt]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.