What’s the ideal investment strategy? Is now a good time to be in shares? How do you get a decent return on cash investments? Should currency risk be hedged?

Questions of this kind, often seen in the financial media, tend to confuse means with ends. The answer in every case is “it depends”.

Think about a group of friends dining out at a restaurant and talking about the property market. One mentions she’s found the “perfect place”, a five-bedroom renovator’s dream, out of town with a three-car garage and a pool.

For another of the group, though, this sounds like a nightmare. This guy lives alone (“what am I going to do with five bedrooms?”), doesn’t drive, doesn’t swim, loathes home maintenance and works long hours in a high-pressure job in the city.

It’s a similar story with investment portfolios. What’s right for one person may be wrong for another. The “right” strategy will depend on the nature of each person’s goals and their sensitivity to any number of risks.

A 25-year-old saving for a deposit to buy a new home in five years may need less exposure to equity markets than someone of the same age saving for their retirement. A couple in their 50’s with inadequate retirement savings may need to take a more aggressive asset allocation then someone who has well and truly enough capital, and does not need to take additional risk.

Many investment professionals will seek to apply a mathematical formula to these questions, presumably with the goal of finding the most efficient or “optimal” trade-off between the return the investor is seeking relative to the risk they are willing to take on.

But people are more complex than that. For a start, it’s tough to identify every single risk an investor might be sensitive to. And even if you can identify the risks, they can’t always be boiled down to a number. The bottom line is that while models can be helpful guides, they can’t account for every variation in people’s lived reality—their circumstances, needs, appetites, values and goals.

This is where plug-and-play cookie-cutter models meet their limits. And that in turn is why Alman Partners True Wealth is focused on understanding what is driving our clients, and adapting to the changing goals and circumstances of each individual.

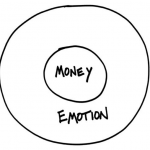

We call this putting the human into investing. Yes, technology can deliver model portfolios via what has been termed ‘robo advice’ However adapting to change requires strategic thinking and emotional balance.

So, it follows that as Trusted Advisers, we need a wide range of investment solutions to match the varied requirements of different clients, and we need to reassess those solutions as each person moves through life.

Stephen Lowry CFP, DFP, FAIM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.