Over the years, our firm has argued that it is virtually impossible to beat markets consistently. Our research of professional active fund manager performance against the market highlights just how efficient markets are.

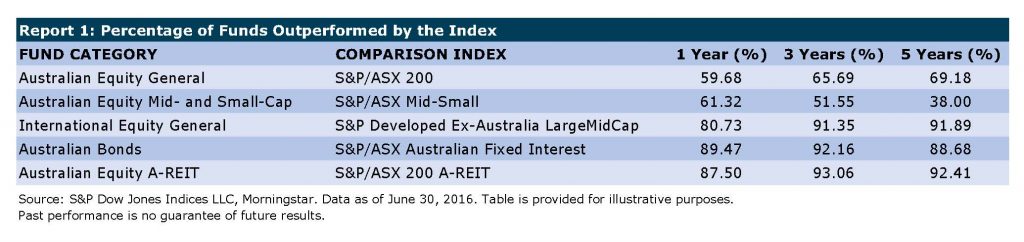

The 2016 SPIVA report, which evaluates the performance of 608 actively managed Australian investment funds & 294 International equity funds, highlights this fact.

The term ‘actively managed’ means the fund managers are trying to beat the market by actively buying and selling shares or trading.

Over 5 years, 69.8% of Australian Equity managers did not beat the market, and this is before fees and taxes. 91.89% of International Equity managers also failed to beat the market over this period, and these people are professionals!

Unfortunately, of those who did beat the markets, it is also impossible to consistently identify those who will do so in the future. The fact is the managers who beat the market this year may not be the ones that do so over the next years.

Despite the spectacular growth of index funds — passive investment vehicles that track market averages and minimise transaction costs — millions of professional and amateur investors continue to buy and sell securities regularly actively. This, despite overwhelming evidence that even professional investors are no more likely to beat the market than monkeys throwing darts at securities listings.

Money managers, at least, are paid to make investment bets. But why do amateurs believe they can outperform markets when it is clear professionals cannot consistently do so?

Many biases and cognitive errors contribute to this costly behaviour, for example, Overconfidence & Optimism. Skyhooks sang the words ‘Ego is not a dirty word’. When it comes to investing, a strong ego generally leads to poor decisions and many scars.

Stephen Lowry CFP, DFP, FAIM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.