In Leo Tolstoy’s great novel ‘War and Peace,’ a Russian general charged with defeating Napoleon and expelling the French from Russian soil argued against rushing into battle, saying the strongest of all warriors were “time and patience.”

It’s an observation worth recalling as the media runs thousands of words analyzing the causes, consequences, and legacy of the Global Financial Crisis of 2008.

The GFC, as it’s known in Australia and New Zealand, is widely considered by economists to have been the worst financial crisis since the Great Depression.

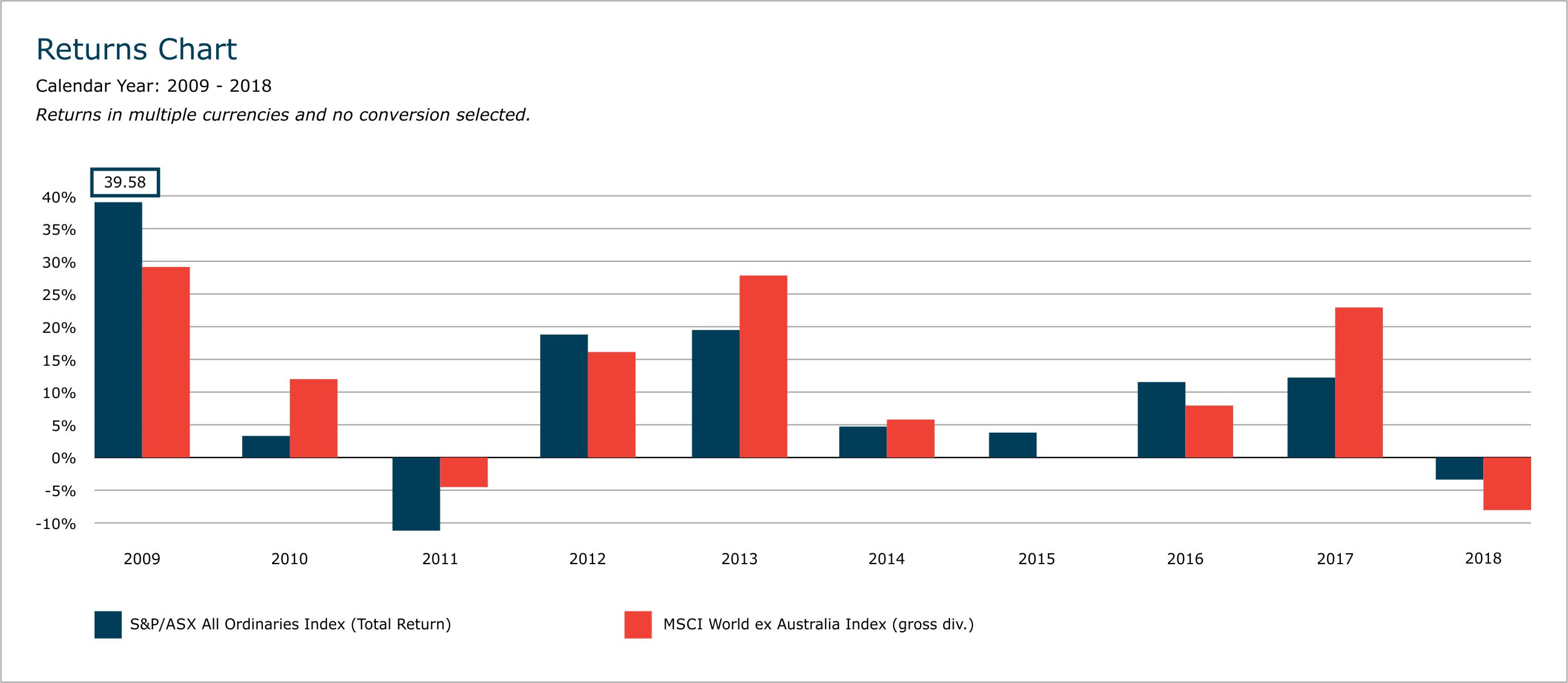

Without regurgitating what was a very challenging time in 2008, we thought it would be a fresh perspective to look at the last 10 years of returns following the GFC and the rewards we have received by staying committed to our strategies. In the chart below, I have highlighted the annual returns of the Australian All Ordinaries Total Return Index and the MSCI World ex Australia Index (gross div).

In the periodic performance graph below, we can clearly see the volatile market conditions over the past 12 months. However, the overall 10-year annualised returns have been quite healthy indeed. Unfortunately, many people did panic in the GFC and sold out their equity portfolios fleeing to cash and term deposits causing devastating damage to their capital positions. The key for today’s investors is to not repeat this mistake of the past.

This last table highlights the benefits of holding a diversified portfolio of both Australian & Global Equities. Basically, over the 10-year period, the Australian Share Market outperformed the Global Market 5 years and the Global Markets outperformed 5 years.

One final point to remember is that investors who want to earn the long term returns of the capital markets should appreciate that market declines are a part of investing and one of the reasons that stocks historically have had a higher return than other investments. Talk to one of our financial adviser for more information about this article.

Stephen Lowry CFP, DFP, FAIM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.