GRADE 10 & 11 STUDENTS: Is a Career in Financial Advice for You?

Join our FREE Short Course

Financial Planning: Basics & Career Pathways

READY TO EXPLORE YOUR FUTURE?

As a preparatory course to the AP Cadetship Program, Financial Planning: Basics & Career Pathways is a highly interactive and educational experience that will be valuable, regardless of whether or not you embark on a Financial Planning career. During the course, you will get a taste of what a career in the advice profession looks like, and if it’s for you. You will also gain a basic understanding of the financial world to use in your own life!

Why Join?

-

Free to attend

-

Gain skills for life!

-

Exclusive swag bag for participants

Who is this for?

Students in Grade 10 & 11 who are curious about a career in financial advice. Limited seats – only 10 spots available!

Course Duration

Held during the school holidays, the 3-day course will be run in mid-January, with specific dates confirmed annually.

Location

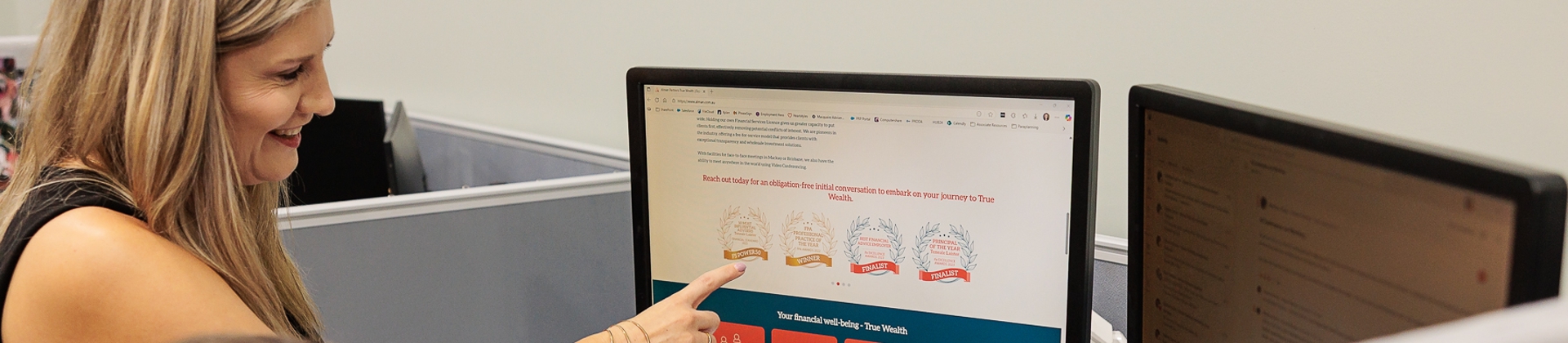

Join us in our stunning Mackay Office at 8 Brisbane Street.

INTENSE, INFORMATIVE, EXPLORATORY, PACKED, FUN, INSIGHTFUL

Myths Busted in this Course

Advisers are just Accountants who tell you to invest.

It’s a boring profession for old people.

It’s all about money & numbers.

You need to be on a large income to be financial set in life.

SIGN ME UP!

EXPRESSIONS OF INTEREST

1 JUL – 30 NOV: Register your interest in attending the following year’s course either online, or call our Mackay office on 07 4957 2572.

CONFIRMATION

Early DEC: You will receive confirmation of your acceptance into the Course, along with specific details.

FINANCIAL PLANNING: BASICS & CAREER PATHWAYS

MID-JAN: 3-day Short Course runs in our Mackay office. Specific dates confirmed annually.

What have participants said about their experience?

What does a Financial Adviser do?

We help families and individuals get their financial house in order and keep it that way for the rest of their lives. An Adviser assists individuals and families to make smart financial choices in line with their values and most important goals, and provide confidence and peace of mind that no matter what happens in the markets, the economy or the world that they have the highest probability of achieving their most important goals.

A Career in Financial Planning would suit me if:

- I am a high achiever with an expected high ATAR.

- I am willing to put in the hard yards (study & employment commitments).

- Have strong leadership qualities.

- I love helping people and inspiring them to make their dreams a reality.

- I care about people and it’s natural to put their interests first.

- I am curious in nature and build strong relationships.

- I have a growth mindset and am a team player.

- I am good with numbers and like solving problems and identifying opportunities.

- I am an avid learner!

What Qualifications would I need?

You will need to obtain an Bachelor’s Degree (AQF7) or higher, including but not limited to, Bachelor of Financial Planning or Bachelor of Commerce or Finance with a Financial Planning major.

- What does a Financial Adviser do?

-

What does a Financial Adviser do?

We help families and individuals get their financial house in order and keep it that way for the rest of their lives. An Adviser assists individuals and families to make smart financial choices in line with their values and most important goals, and provide confidence and peace of mind that no matter what happens in the markets, the economy or the world that they have the highest probability of achieving their most important goals.

- A Career in Financial Planning suit me if:

-

A Career in Financial Planning would suit me if:

- I am a high achiever with an expected high ATAR.

- I am willing to put in the hard yards (study & employment commitments).

- Have strong leadership qualities.

- I love helping people and inspiring them to make their dreams a reality.

- I care about people and it’s natural to put their interests first.

- I am curious in nature and build strong relationships.

- I have a growth mindset and am a team player.

- I am good with numbers and like solving problems and identifying opportunities.

- I am an avid learner!

- What Qualifications would I need?

-

What Qualifications would I need?

You will need to obtain an Bachelor’s Degree (AQF7) or higher, including but not limited to, Bachelor of Financial Planning or Bachelor of Commerce or Finance with a Financial Planning major.