Starting the next chapter of your journey into retirement is something most people have been waiting for their whole working lives, however, there are a few things to consider when planning to retire.

1. Make a retirement plan.

It is never too early to plan for your retirement, and it is never too late to make smart decisions about your retirement. After many years of hard work, this is an exciting next chapter of your life, to be filled with enjoyment and relaxation.

A pre-retirement plan allows you to have a plan in place that is designed to help boost your retirement income. This plan may comprise a number of strategies, and these will depend on your circumstances, goals and objectives.

Once you retire your investment journey does not end, with most people living well into their 80s, you will need your capital working hard to provide you with an income for at least 20 years. Having a solid investment plan in place that helps you stay on course can help you achieve your retirement goals.

2. Consider your lifestyle and priorities.

Take this time to reflect and consider what your goals are. Where do you see yourself living? Do you want to downsize? How would you like to fill your days? Most importantly what do you want to experience and what is important to you? Use these questions to create a vision of what your retirement looks like.

For some, this next chapter can be difficult. Work is a big part of our lives and who we are, it is important to understand that there can be emotional impacts and that is normal, remember be kind to yourself. Retire at a time that is right for you and alternatively, you may decide to move to part-time work to ease into retirement.

Once you have made this decision there are a number of strategies your adviser can implement to help you stay on track to meet your retirement goals.

3. Determine your income needs.

The Association of Superannuation Funds of Australia states the average annual budget for retired couples aged 65-84 in 2022 is between $44,034 for a modest lifestyle and $68,014 for a comfortable lifestyle, and for singles, it’s between $30,582 and $48,266. These figures are based on averages and do not consider your objectives, goals and living requirements.

In order to determine your income needs, consider your yearly expenses. It is important to be realistic when undertaking this task and account for potential costs that may come up such as home repairs or medical bills. This will give you an idea of what your base living expenses are and you can build from that when determining your retirement income needs. By budgeting and making smart investment decisions you can help your assets last longer throughout your retirement years.

4. Understand your pension options.

When can you access your superannuation?

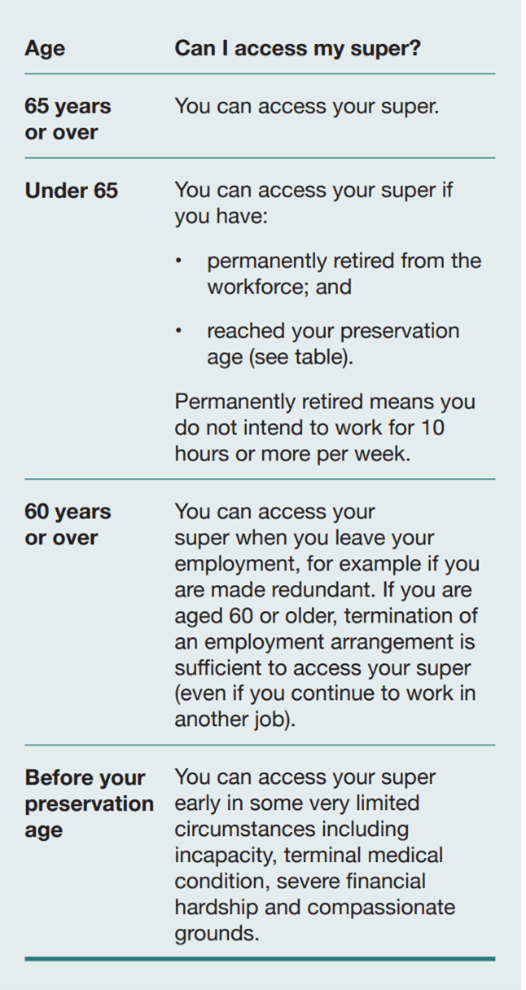

There are restrictions on when you can access your super. You can access your super when you meet a “condition of release.” If you have a defined benefit account you will also need to meet the requirements of your scheme.

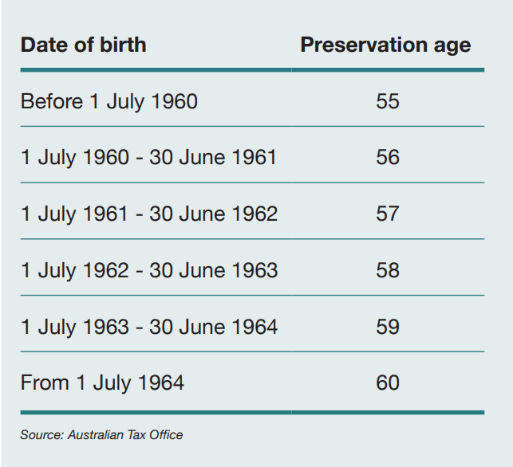

If you have reached your preservation age but have not yet retired, you may have the option to access your super through a transition to retirement pension. However, there are restrictions on the amount you can withdraw and there may be tax applicable depending on your age. You should discuss this strategy with your adviser to determine if it is right for you.

Once you have reached your preservation age and a condition of release converting your super to pension, an account-based pension is the most common type of pension. Super pensions are tax-free after the age of 60, however, if you are under 60 your taxable component is taxed at your marginal tax rate, but you may be entitled to a 15% tax offset. There are a number of rules and regulations in regard to the super environment therefore it is always best to seek advice from your trusted adviser.

5. Know your entitlements.

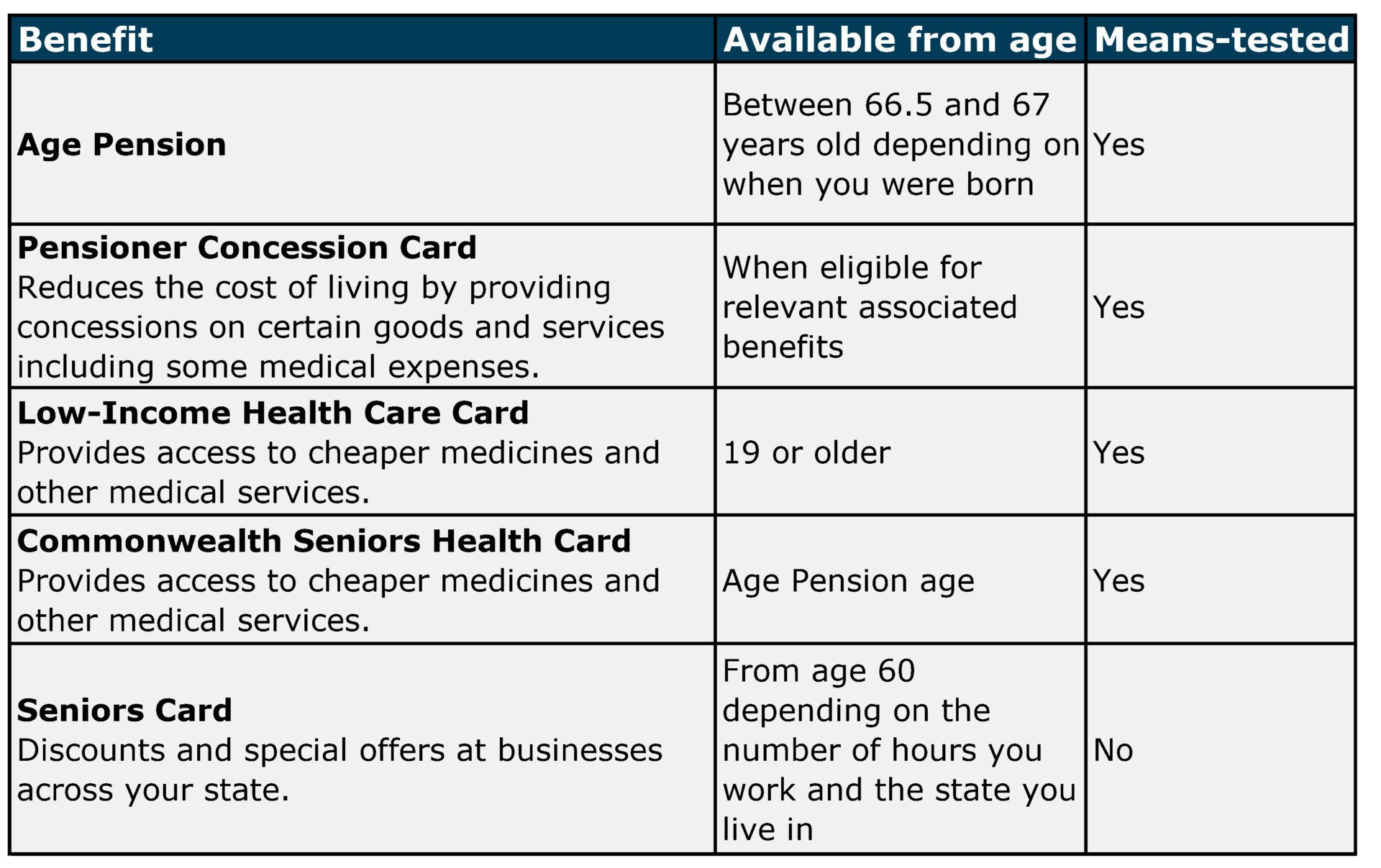

There are a number of government entitlements that can assist Australians, below provides a summary of some of the benefits available:

The amount of Age Pension you are eligible for (and the amount you receive) will depend on how much income you get and how much your assets are worth. This is calculated using two main tests:

- An income test – refers to any investment income or salary earnings.

- An assets test – based on your lifestyle and financial assets (your home is not included).

The test that results in a lower outcome is the one that determines how much Age Pension you are eligible to receive. If you are eligible for the Age Pension you will also automatically receive the Pension Supplement. As of 20 September 2022, the combined maximum rate for these benefits is:

- $1,026.50 for a single person per fortnight.

- $773.80 each for a couple per fortnight.

There are other benefits linked to the Age Pension such as the Pensioner Concession Card. So even if you will only be eligible for a very small Age Pension it may still be worth making an application.

These five tips should provide you with some food for thought and help you plan a comfortable retirement that is right for you. This can be a tricky area to navigate so if you have any questions or would like to put a retirement plan into place contact Alman partners to discuss your next chapter.

Caitlyn Kent (GDipFinPlan, DipFP, BCom[Acc]) is an Employee of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.