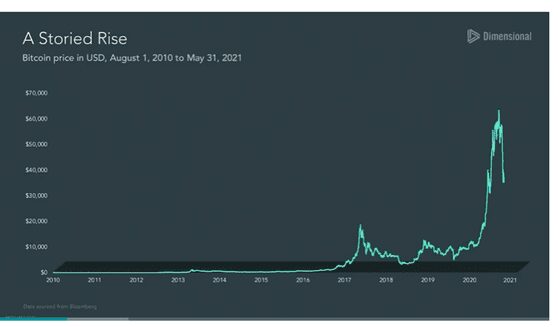

For those of you, who have managed to follow any news or updates outside of COVID, you would notice that Bitcoin and cryptocurrencies in general have been in the news a lot, due to the recent large movements (up and down) in its price. As the chart below demonstrates, there has been significant appreciation in the value of Bitcoin, but it is an extremely volatile asset which makes it great for news bites.

What are cryptocurrencies?

Cryptocurrencies, such as Bitcoin, emerged around 1999 at the peak of the dot com boom. Unlike traditional currencies – there is no physical currency – no paper or metal, and there is no central bank issuing any currency or any one nation that stands behind it.

Cryptocurrencies are basically digital codes made by computers and stored in a “digital wallet.” For instance, with Bitcoin, its creator decided that there would only ever be 21 million Bitcoins and there are close to 18.5 million of these in circulation as of March 2021. The transactions (transfers) are recorded in a public register called the “Blockchain.”

Now while most people have heard of Bitcoin, did you know there are more than 8,000 cryptocurrencies in circulation as of January 2022!

Bitcoins can be earned in several ways – you could buy them using the good old traditional money or mine them. Mining involves the use of powerful computers to solve highly complex mathematical puzzles – so not everyone’s cup of tea for sure.

What drives its value?

Cryptocurrencies have been under intense media coverage. The basic premise around these digital currencies was that the age of traditional currencies was over. However, this has not quite materialised. As of March 2021, even though 1 Bitcoin was worth $57,000, the total value of Bitcoin in circulation was less than 0.5% of the aggregate value of global stocks and bonds.

The price of Bitcoin is tied to supply and demand. Although the supply of Bitcoin is (artificially) limited, that shortage will more than likely be circumvented by so many other new cryptocurrencies being launched.

Should you consider including Bitcoin in your portfolio?

From an investor’s point of view, investing in shares, property, or bonds is expected to generate income in the form of dividends, rent, or interest although the timing and quantum of these may be uncertain. There is no income generated from Bitcoin/cryptocurrency. In that sense, Bitcoin is a bit like holding cash – you can use it to pay for goods and services but most of the goods and services are not priced in Bitcoins.

It is important as with any investment decision to link it back to your goals. As an example let us consider the three most common investor goals and how crypto relates to these:

- Investors would like a positive expected return i.e., grow wealth. Whilst Bitcoin value has increased it is important to remember Bitcoins do not give you future claim to income or cashflows. If you own a Bitcoin today, then you will own the same one Bitcoin years from now. Your wealth generation outcome is dependent on the value of Bitcoin increasing and not due to any underlying income/growth generation.

- Reduce uncertainties of the outcome i.e., help them move forward on their financial journey with greater certainty. Unfortunately, crypto/Bitcoin has proven to be a very volatile asset and as such unlikely to dampen volatility in an investor’s portfolio it could in fact increase it.

- Liquidity function i.e. cash funding goal. Cash gives you the confidence of the value that you have will remain to be able to meet your short-term needs but given the volatility with cryptocurrencies where the price movements of 10-20% daily are not unheard of, crypto, unfortunately, does not offer that safe haven of holding value, that provides confidence to investors that they can utilise it to fund their short-term goals.

There are some other issues to consider as well:

- There is no issuing authority that backs cryptocurrencies and it exists only as a computer code saved in a digital wallet. You can access this via username and password. Should you forget the password after a few attempts you are locked out for good. A recent New York Times article profiled the holder of more than $200 million worth of Bitcoin that he can’t retrieve. His anguish is not unusual — a prominent cryptocurrency consulting firm estimates that 20% of all outstanding Bitcoin represents stranded assets unavailable to their rightful owners1.

- Mt. Gox, a Tokyo-based Bitcoin exchange launched in 2010 was at one point in time one of the world’s largest intermediaries for Bitcoins accounting for 90% of the transactions. In February 2014, it suspended trading and filed for bankruptcy sighting several hundred thousand lost and stolen Bitcoins.

- Extreme volatility in price can be very disconcerting for an investor (although a trader may consider it attractive). To illustrate, the price of Bitcoin peaked at $65k in April 2021 and then dropped down to $30k, a 50% drop in 6 weeks. This volatility highlights the underlying uncertainty around it – technical uncertainty, political uncertainty (for instance China has clamped down on the use of Bitcoin), and environmental impact (huge electricity consumption in mining cryptocurrency).

While it is a hot topic, I think investors must truly be aware and consider if this is appropriate for their situation. As James Oliver so succinctly put forward on HBO’s Last Week Tonight2 when talking of cryptocurrency:

“Everything you don’t understand about money combined with everything you don’t understand about computers.”

Source:

1 Nathaniel Popper, “Lost Passwords Lock Millionaires Out of Their Bitcoin Fortunes,” New York Times, January 12, 2021.

2 March 11, 2018.

Niyati Khanna (CFP® Professional, CA, MBA [Finance & Strategy]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.