Harry M. Markowitz, an economist who launched a revolution in finance, changing traditional thinking about buying stocks and becoming a Nobel-Winning Pioneer for his breakthrough in 1990, sadly passed away in San Diego this June at 95 years of age.

Until Dr Markowitz came along, the investment world assumed that the best stock-market strategy was simply to choose the shares of a group of companies that were thought to have the best prospects.

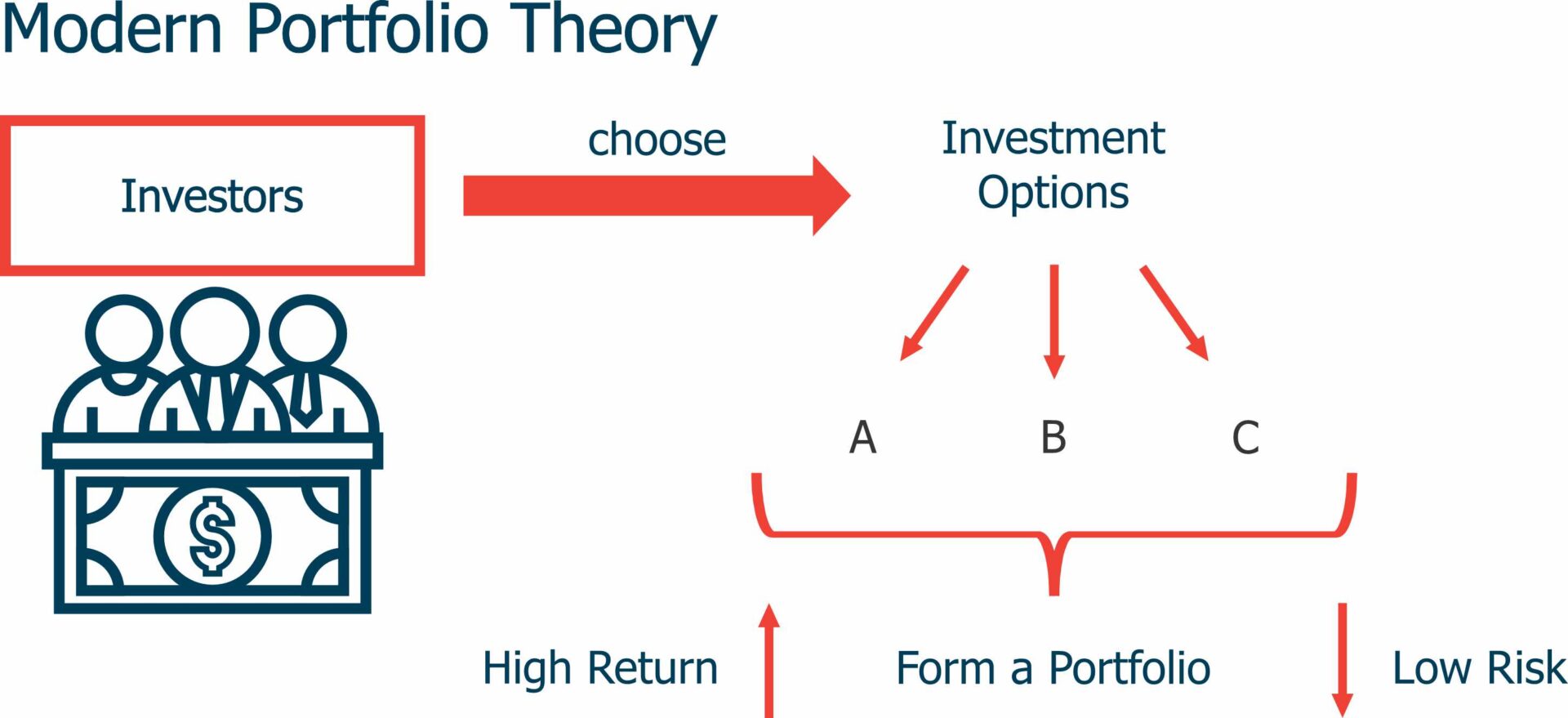

In 1952, he published his dissertation, “Portfolio Selection” which overturned this common-sense approach with what became knowns as Modern Portfolio Theory; world-wide referred to as M.P.T.

The M.P.T. essentially explores the relationship between risk and reward showing that the risk in any portfolio is less dependent on the riskiness of its component stocks and other assets than how they relate to one another. This was the first time when the benefit of diversifying portfolios had been analysed and further quantified.

This investing model, in other words, explains investing with the motive of taking the minimum level of risk and earning the maximum amount of return for the level of acquired risk. With a view of the overall risk of the portfolio having securities being reduced through the means of diversification. Simply, combining assets with different risk and return characteristics to optimise the portfolio.

Example

There is an individual who wants to invest in a portfolio. They have two portfolios to select from, which are as follows:

- The first portfolio consists of a mix of bonds and different stocks that gave a return of 10% annually on average, but at the same time differed by the range of as much as 15% annually (returns, in this case, usually differed between -5% and +25 %).

- On the other hand, the second portfolio consists of a mix of bonds and different stocks that gave a return of 10% annually on average, but at the same time differed by a range of only 3% annually (returns, in this case, usually differed between 7% and 13%).

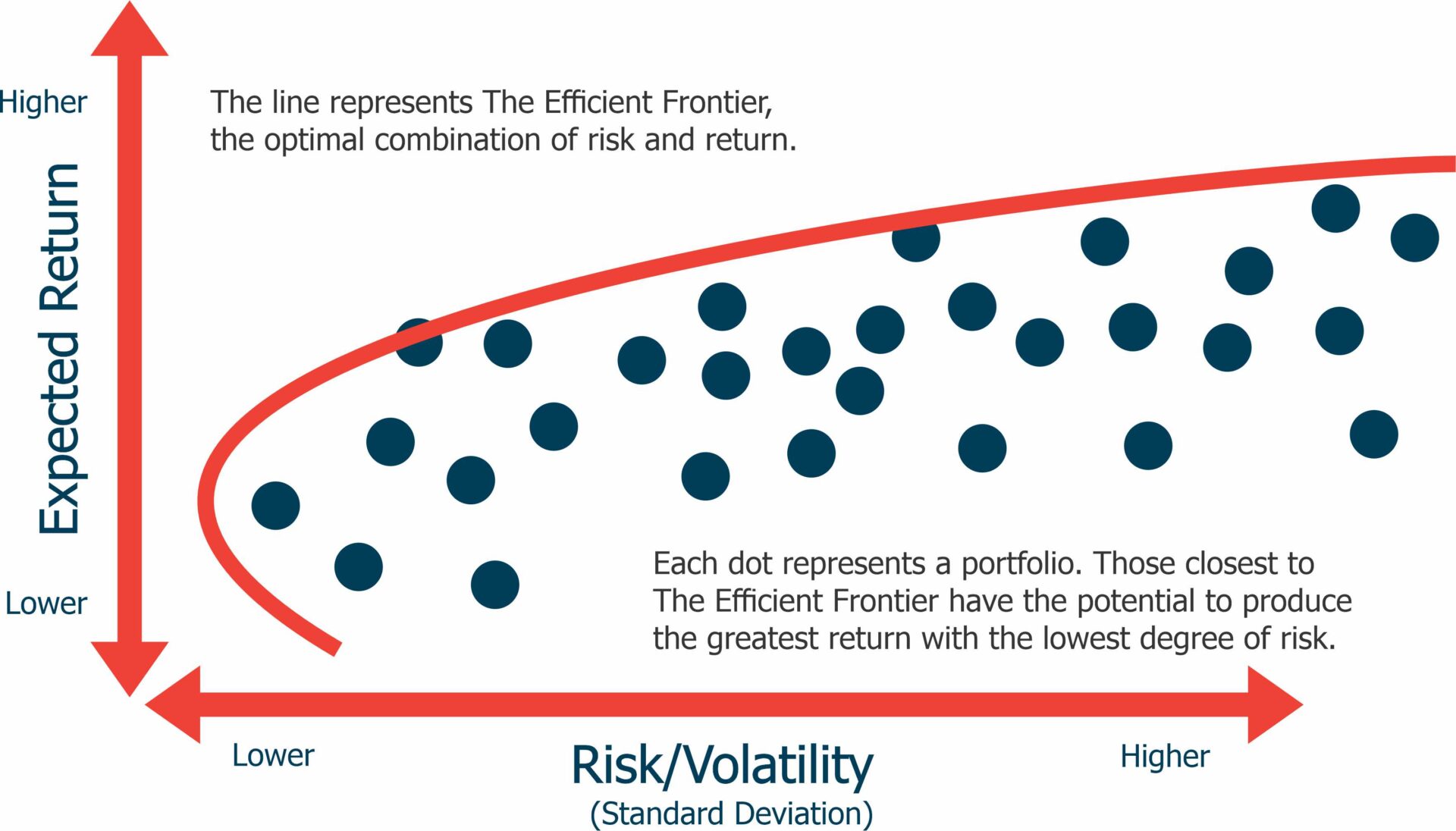

According to the Modern Portfolio Theory graph, which investment portfolio should a person consider?

Analysis

- In both scenarios, the average expected return on the investment is 10%. However, in the first portfolio, one could get a return of as much as 25%, which sounds attractive, but at the same time, there prevails a huge risk where one might lose 5% as well because the range usually differs between -5% and +25%.

- On the other hand, in the case of the second portfolio, a less return range of between 7% and 13% may be less attractive to the investor, but in that case, it is expected that one will not lose his money, which makes the investment less risky than the first portfolio.

- According to the Modern Portfolio Theory graph, an investor invests with the motive of taking the minimum level of risk and earning the maximum amount of return with that minimum risk taken, so in the present case, one should choose the second portfolio as he is getting the same average expected return with the less level of risk.

The Modern Portfolio Theory has gone from the halls of academia to the investment management mainstream today and being implemented by various risk managers, investment institutions and related persons.

Dr Markowitz’s Theory is a key component in Alman Partners’ Investment Philosophy.

Vale

Harry Max Markowitz

24th August 1927 – 22nd June 2023

Reference:

Modern Portfolio Theory (MPT) – What Is It, Example (wallstreetmojo.com)

Harry Markowitz, Nobel-Winning Pioneer of Modern Portfolio Theory, Dies at 95 – The New York Times (nytimes.com)

What Is Modern Portfolio Theory (MPT)? (thebalancemoney.com)

Modern Portfolio Theory (MPT) – Overview, Diversification (corporatefinanceinstitute.com)

Veronika Holubova (MFinP, GradCertFP, ADFP, DipFP) is an Authorised Representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.