I came across one of Carl Richard’s fantastic sketches this week, which always provoke reflection and interpretation (and often a chuckle in the process).

My attention immediately went to ‘Scary Market’ (referring to the share market) with the curiosity of whether this is what people are feeling at the moment or whether this is just the normal state for investors in general?… Then I pondered whether ‘Hugs’ were actually a ‘valuable’ contribution, without having a well-thought-through personal financial plan, built on facts. Otherwise, it might be hugs for different reasons!

For me and the AP client community, knowing that our portfolios are broadly diversified across the globe (thousands of securities), gives us comfort that if our portfolios are worth nothing, we have much bigger problems than our wealth to deal with. We also know that companies and properties are volatile Asset Classes, they always have been and always will be, so it’s important that we take a long-term perspective and build defensive assets, like bonds into portfolios to account for short- and medium-term goal funding needs and reduce overall portfolio volatility. In essence, the bumpier the journey, the higher the long-term expected returns we can estimate.

Everyone usually loves a smooth ride, which is why the banks are so profitable, but the returns are commensurate to the risk/bumps taken. Some of us are more tolerant in taking the bumps, but in most cases, we all have a threshold, and this is where the hugs are extremely valuable!

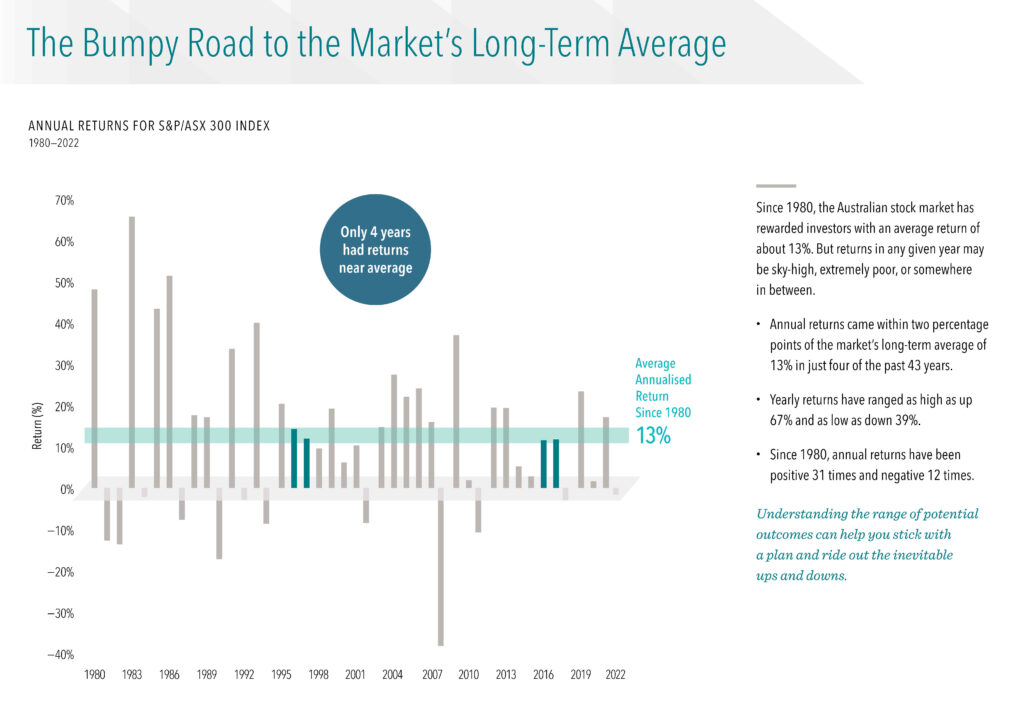

Remember that ‘Markets’ are forward-looking and price in their expectations around future company performance immediately, whereas economic data is backward-looking. Investing in markets is uncertain. That uncertainty never goes away; however, it is the role of markets to price in that uncertainty. There were a lot of negative surprises over the past 40 years, but there were a lot of positive ones as well. The net result from the Australian market was an average annualised return of 13% p.a. (ASX 300), which seems overly generous and even hard to believe given recent experience. It’s because of uncertainty that we have a positive premium when investing in stocks vs. relatively riskless assets. It’s a tribute to human ingenuity that when negative forces pop up, people and companies respond and mobilise to get things back on track.

Dimensional Fund Advisors, AUD.

In life and our finances, there will always be bumps to the day we die, we just need to live with confidence and peace of mind that we are only taking on an appropriate level of bumps to achieve our most important goals, with consideration to our age and our tolerance… As you all know, if you’re ever in need of a hug (i.e., there is something of a financial nature that is bothering you) between your annual progress reviews, we are always available for your call or visit.

Paul Shepherd (CFP® Professional, BEng, DipMgt, DFS[FP], AIF®) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.