With volatility in the markets due to the pandemic, inflation, war and the noise of the media instilling fear of a recession, this may cause investors to consider if they should adjust their portfolio and ask, “should I change my asset allocation to take advantage of the discount on shares?”

This question ultimately is asking if we should be timing the market. Timing the market is not easily achievable even for the most experienced traders, even when taking into consideration market cycles, making it an onerous task to try to determine consistently and accurately when to get in and out of the market. Various studies completed by Morningstar, Financial Analyst Journal and Journal of Financial Research, and many others, have confirmed that successfully timing the market is nearly impossible, compared to staying fully invested over the same period.

Timing the market is changing the funds you are invested in (asset allocation), by either selling or investing based on market predictions. The risk of timing the market is missing out on positive price movement while waiting to make changes and investing at the incorrect time. Studies show that investors that are buying and holding yield much higher returns. To quote Gene Fama Jr., a famed economist, “Your money is like a bar of soap. The more you handle it, the less you’ll have.”

The cost of trying to time the market

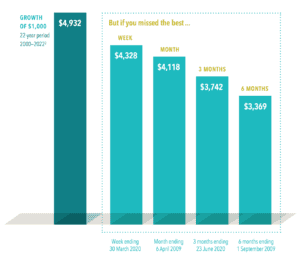

In changing your asset allocation there is potential for you to be out of the market for a short period. In this hypothetical investment scenario, the above chart shows the impact of being out of the market and the effect it can have on a portfolio.

Changing your asset allocation based on market movement and predictions alone would be considered timing the market. Instead, during this period in time when stocks and bonds are at a lower price, the opportunity should be used to rebalance your portfolio back to your chosen asset, therefore retaining your original asset allocation chosen for your individual needs and circumstances whilst taking advantage of the discounts available in the market.

Having a well-engineered, diversified asset allocation accounting for the risk appetites, goals and objectives of each individual, is imperative to provide you with the highest likelihood of you achieving your goals. It is also important to avoid the temptation to judge the success of your portfolio over short time frames and make changes on this basis. The right asset allocation and financial plan will account for changes in the market, and by rebalancing the necessary adjustments will be made. We believe that the market works, and all information is already incorporated into the price.

The takeaway is, diversification, discipline and sticking to your agreed asset allocation and plan, with regular rebalancing are key to providing you with the highest likelihood of achieving your goals.

Caitlyn Kent (GDipFinPlan, DipFP, BCom[Acc]) is an Employee of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

References

Bloch, B. (2022) “Market Timing Fails as a Money Maker.” Available at: https://www.investopedia.com/articles/trading/07/market_timing.asp (Accessed: November 20, 2022).

Booth, D. (2022) “Trust the Financial Advisor Who Trusts the Market.”

Seagler, S. “The Importance of Asset Allocation,” Snider Adviser. Available at: https://www.snideradvisors.com/the-importance-of-asset-allocation/ (Accessed: November 20, 2022).

Silverblatt, H. (2022) “U.S. Equities Market Attributes October 2022.” Available at: https://www.spglobal.com/spdji/en/commentary/article/us-equities-market-attributes (Accessed: November 20, 2022).

Stevens, P. (2021) “This chart shows why investors should never try to time the stock market.” Available at: https://www.cnbc.com/2021/03/24/this-chart-shows-why-investors-should-never-try-to-time-the-stock-market.html (Accessed: November 20, 2022).

Topiwala, P. and Dai, W. (2022) “Surviving black swans: The Challenge of Market Timing Systems,” Journal of Risk and Financial Management, 15(7), p. 280. Available at: https://doi.org/10.3390/jrfm15070280.