Australian All Ords reach a record high!

S&P 500: an all-time record high!

FTSE hits pandemic High!

By most indications, the Australian and share markets around the world have done well. The run-up in the markets in Australia and globally has had mixed responses from investors. They are cautiously happy. Most are left with a sense of impending upheaval. It is an interesting situation, where the overwhelming view is that there is a crash or correction around the corner. This presents itself in a variety of ways:

- Investors wanting to sell – I will sell now and book profits. The profits can disappear very quickly.

- Investors reluctant to make new purchases – the traditional “Buy low sell high” mantra.

This “Record-High” anxiety is fuelled further by the financial journalist reporting, often indicating that the Laws of Physics apply to financial markets – i.e. gravity applies to all physical things and what goes up must come down. The news headlines often propagate this thought, here is a sample of some of the headlines:

“Stocks Head Back to Earth,” Wall Street Journal 2012 1

“Weird Science: Wall Street Repeals Law of Gravity,” Barron’s 2017 2

…low interest rates have “helped stock and bond markets defy gravity.” Los Angeles Times 3

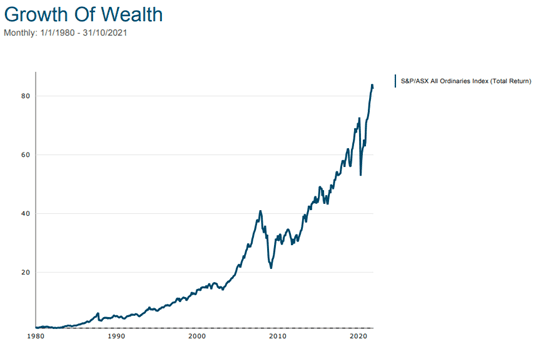

This can cause some investors to shy away fearing an imminent crash and the fear of buying stocks at their peak. But shares are not physical objects that are kept propped up with some effort or support. It is important to remember what drives the prices of shares – the prices are based on the expected earnings and dividends from these companies. If the expectation is that a company will continue to grow and be profitable, given there are thousands of business managers and employees who go to work each day to work on projects to produce goods and services that are of value to us, the share price will reflect this and rise. Of course, there will always be some companies/ ideas that may end in failure, but as the chart below indicates, the markets will tend to reward investors for their capital:

A new high or low for that matter should be treated with neither excitement nor alarm but as an indication of the collective judgement of the market on what the earnings and returns for tomorrow look like.

Historical US market data also suggests that there is no significant difference to the long-term returns between investing around record highs versus a strategy that invests after a significant decline in the markets:

All Rise

Average annualized returns for S&P 500 Index after market highs and declines

| 1 year later | 3 years later | 5 years later | |

| After new market high | 13.9% | 10.5% | 9.9% |

| After 20% market decline | 11.6% | 9.9% | 9.6% |

Human beings are conditioned to think that there must come a fall after a rise, which could tempt us to modify our portfolio or change our strategy. However, this kind of pattern exists only in our minds. The key, therefore, is to be disciplined and stick to your plan and keeping in mind “markets work and time in the market is key.”

Niyati Khanna (CFP® Professional, CA, MBA [Finance & Strategy]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.

1 Jonathan Cheng and Christian Berthelsen, “Stocks Head Back to Earth,” Wall Street Journal, February 11, 2012.

2 Kopin Tan, “Weird Science: Wall Street Repeals Law of Gravity,” Barron’s, August 7, 2017.

3 Russ Mitchell, “Tesla’s Insane Stock Price Makes Sense in a Market Gone Mad,” Los Angeles Times, July 22, 2020.