Gold has long been regarded as a safe haven – an asset investors flock to during periods of economic uncertainty. Historically, it has moved inversely to stock markets and is often considered a hedge against inflation. But does gold truly belong in a well-constructed, evidence-based investment portfolio? Let’s take a closer look.

Gold as an Inflation Hedge

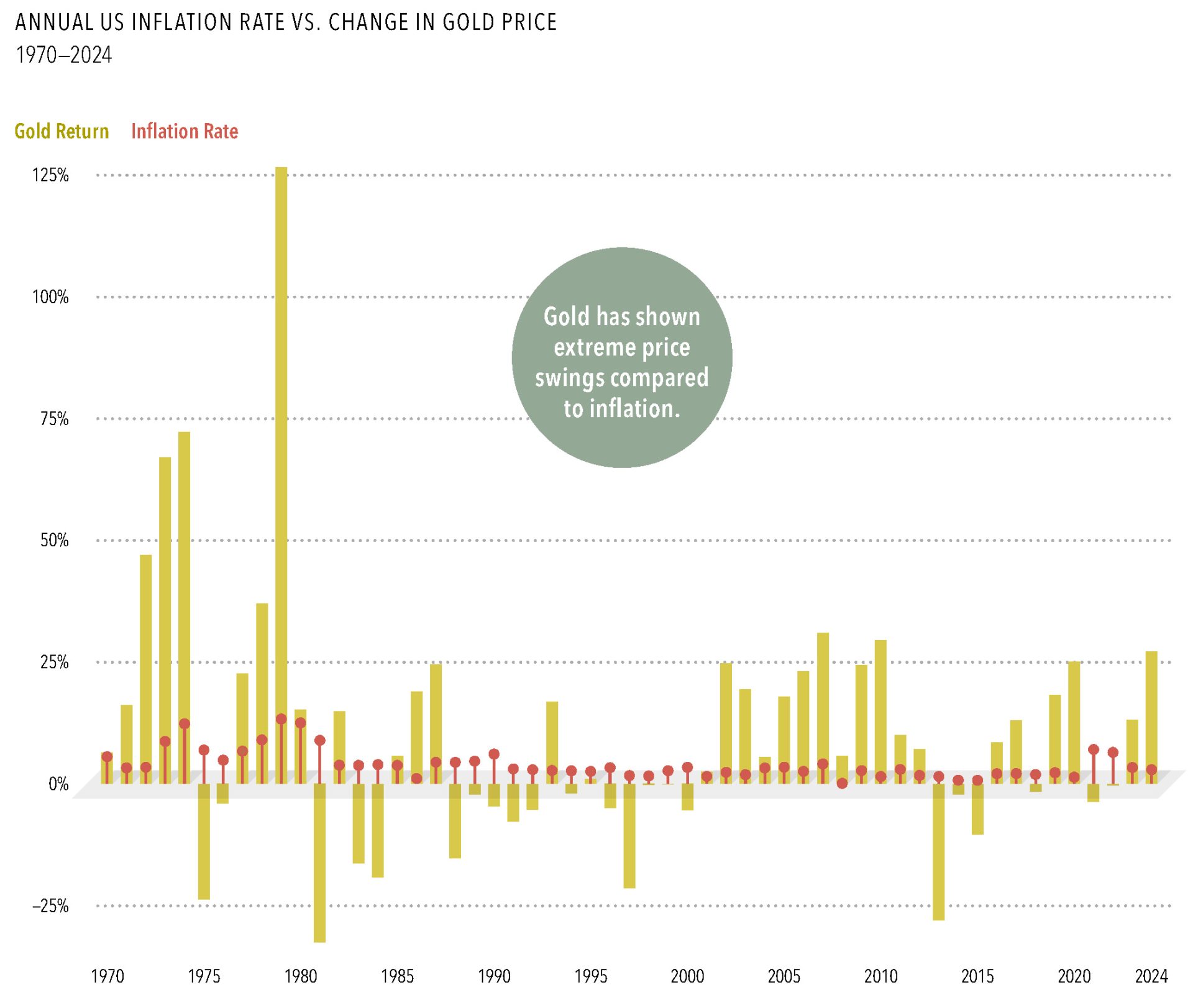

One commonly held view is that gold effectively combats inflation. In theory, an ideal inflation hedge would exhibit price movements in line with inflation rates – but gold’s volatility tells a different story.

As seen in historical data, gold prices have swung dramatically compared to inflation rates, particularly since the 1970s. While gold has sometimes outpaced inflation, it has also suffered periods of severe decline, raising doubts about its reliability as a true inflation hedge.

Source: https://my.dimensional.com/dfsmedia/f27f1cc5b9674653938eb84ff8006d8c/155962-source/gold-hasnt-been-effective-at-tracking-inflation.pdf

Gold as a Safe Haven Against Market Volatility

In times of economic and geopolitical turmoil, investors often turn to gold for security. This surge in demand can drive prices higher, creating the illusion of stability. However, it’s important to recognise that this price increase is often driven by emotion, rather than fundamental changes in gold’s intrinsic value.

A good question to ask would be what influences growth in the value of gold. There are four key factors:

- Jewellery demand

- Industrial uses

- Inflation hedging

- Flight to safety during uncertainty

Gold does suffer from 2 shortcomings – lack of utility, and it is not procreative. Unlike stocks, bonds, or property, gold is not an income-generating asset. It offers no dividends, interest, or rental income, making it fundamentally different from traditional investments. Its value is largely psychological, driven by demand rather than productive utility.

Can Gold Consistently Outperform?

Gold has outpaced the broader market over the last 25 years, but does this reflect real value? Other precious metals like rhodium and platinum are even more scarce and have stronger industrial applications – yet their volatility prevents them from being considered long-term safe-haven assets.

Consider the 2008 Global Financial Crisis (GFC): gold prices initially surged past $1,000 per ounce, but as panic deepened, distressed investors liquidated assets – including gold – to regain liquidity. This led to a sharp decline to $692 per ounce by October 2008. While gold recovered in the following years, its short-term volatility highlighted the risks of relying on it solely as a safe haven.

To quote Warren Buffet – “Buying gold is taking a long position in fear, i.e. you are really betting on fear. Your return from gold really depends on people becoming more afraid in the next few years. If they become more afraid, you make money, and if they become less afraid, you lose money.”1

The Role of Gold in a Portfolio

A robust investment strategy acknowledges volatility and incorporates diversification. A well-structured portfolio, invested across various asset classes, benefits from long-term market compensation for risk. Before allocating gold to your portfolio, ask yourself:

- What purpose does gold serve in my portfolio?

- Am I relying on gold for stability or speculative gains?

- Does gold align with my broader investment strategy?

Gold may offer temporary relief during economic turbulence, but its long-term viability as a core investment is uncertain. If included, it should be strategically weighted rather than relied upon as a primary growth asset.

Source: 3 Things Warren Buffett Has Said About Gold | INN

Niyati Khanna (CFP® Professional, CA, MBA [Finance & Strategy]) is an Authorised Representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.