Case Study:

The Mouse Wheel of

Corporate Life

Alman Partners creates tailored financial solutions to help families achieve their goals. The following case study demonstrates how we consider clients’ unique circumstances to provide custom personal financial planning services.

The Situation

Until last year, executive Simon* was pretty casual about money. He was a Senior Executive aged 52 working in a large multinational company in the resource sector earning $220,000 p.a. Having grown up without much money, he was determined to provide well for his family. Simon expressed his frustration at being trapped on the mouse wheel of corporate life. He felt as though he couldn’t stop or all the cards would fall.

Simon’s wife Laura had recently returned to her career in Graphic Design after spending 10 years being the children’s primary carer. She was earning $80,000 p.a. Laura’s priority was to see their children succeed in life and complete university. She also wanted to spend more quality time with Simon and their children.

Some more information about the family:

- The family home was worth $700,000 with $325,000 owing on the mortgage.

- Simon and Laura jointly had about $650,000 in super with only employer contributions. The investments were in a high-growth portfolio.

- They also had 7,342 BHP shares valued at $220,000, fully paid with a cost base of $85,700.

- They owned two investment properties valued at $850,000 with $525,000 debt. The properties had capital gains of $80,000 combined, with rent covering the debt.

- Simon wanted to upgrade the family home.

- Laura had very strong feelings about providing their children with full support at university, with costs of $25,000 p.a. for 3 years per child.

- Simon would like to retire at age 60, debt-free and with an annual income of $75,000. He had no idea how much money would be required to achieve this.

- Simon had income protection insurance for 75% of his salary, which had not been reviewed for 4 years. He also had Death and TPD insurance of $800,000. Laura had no insurance.

- Their wills were established in 1998.

- They indicated their annual budget was around $95,000. However, they couldn’t demonstrate any evidence of savings or major debt reduction over the past 4 years.

What they wanted to know was:

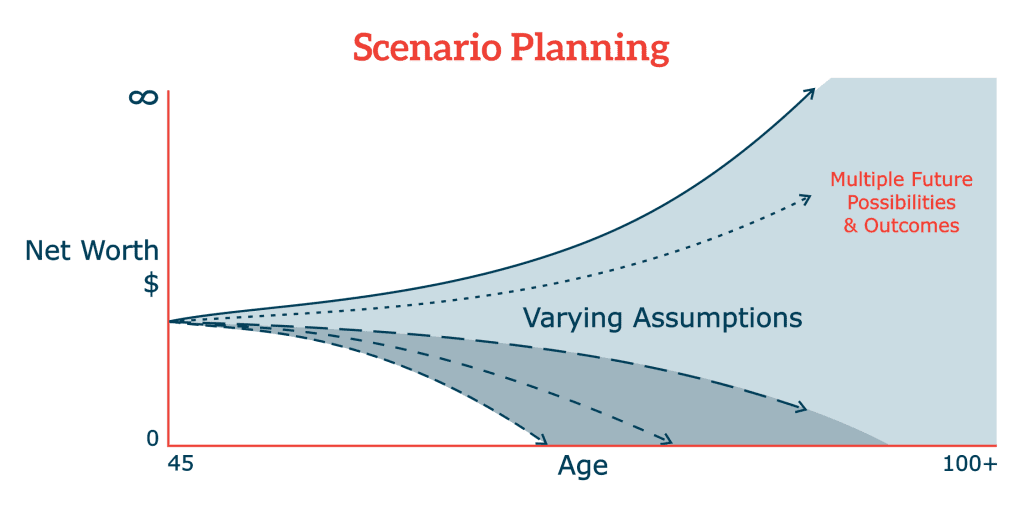

- Were they on track financially compared to where they needed to be?

- What impact would the house upgrade have on their other goals?

- How much money would it take to secure their goal retirement income?

- How will they fund their children’s education commencing in two years for the eldest?

As you can see, Simon and Laura had no real idea of where they are going or how they were going to get there.

This is where the planning begins.

*Names have been changed to protect the individual’s identity.

Get Started Today

Contact us for more information on our financial services.

We will get back to you shortly.

"*" indicates required fields