The 2024 Federal Budget delivers cost-of-living-relief for every Australian, including tax cuts and $3.3 billion for energy and rental subsidies. But does the budget set up Australia for future success?

For 2023-24, the government will bank a $9.3 billion surplus, but the forecast is for a combined deficit of $122 billion in coming years as commodity prices fall and softer labour markets reduce tax receipts from wages. The ongoing absence of meaningful revenue or expenditure reform in the annual budget is a concern.

Inflation is forecast to moderate from 3.5% in FY 2024 to a range of 2.5% to 2.75% over the next four years.

The Future Made in Australia initiative is the headline act, promising $23 billion for investment and incentives in clean energy and critical minerals.

Below we summarise the key Budget points that may impact strategies for our clients and families or their businesses. There were no new announcements we expect to materially impact client strategies.

Superannuation

- Contribution Caps – from 1 July 2024, the concessional (tax-deductible) contribution cap will increase from $27,500 to $30,000. The non-concessional cap (which is always 4 times the concessional cap) will increase from $110,000 to $120,000, which means the new 3-year bring-forward amount grows to $360,000. If you have over $1.66 million in superannuation, your 3-year bring forward cap will be $240,000 or less (as you are approaching the unchanged $1.9 million Transfer Balance Cap, which is the lifetime limit on the amount you can transfer into a tax-free pension).

- Superannuation Guarantee – there were no changes to currently legislated rates of the superannuation guarantee, which will increase from 11.0% to 11.5% on 1 July 2024. A final increase to 12% is expected from 1 July 2025.

- 30% tax on $3 million+ individual account balances (Division 296 Tax) – As previously announced, the Government intends to introduce legislation to reduce the tax concessions available to individuals with a total superannuation balance exceeding $3 million, from 1 July 2025. There was virtually no mention of this tax in the Budget. The measure will not place a limit on the amount of money an individual can hold in superannuation, but it does introduce a tax on unrealised gains on some super accounts, which will be the first of its kind. There may be a federal election prior to 30 June 2025, and a change of government could still result in this law not proceeding. The Greens want the $3 million limit reduced to $2 million and indexed to inflation.

- Super on parental leave – Parents accessing the government-funded paid parental leave scheme will be paid the superannuation guarantee from July 2025. Under the current program, a couple with a newborn or newly adopted child can access up to 20 weeks of paid parental leave at the national minimum wage. The plan, which Labor will take to the next election, would see superannuation paid at 12% on the national minimum wage of $882.75 per week.

- Payday superannuation to proceed – the proposed payday superannuation measures will proceed from 1 July 2026. This will require employers to pay an employee’s Superannuation Guarantee at the same time as their salary and wages. This measure is not yet law.

Individuals

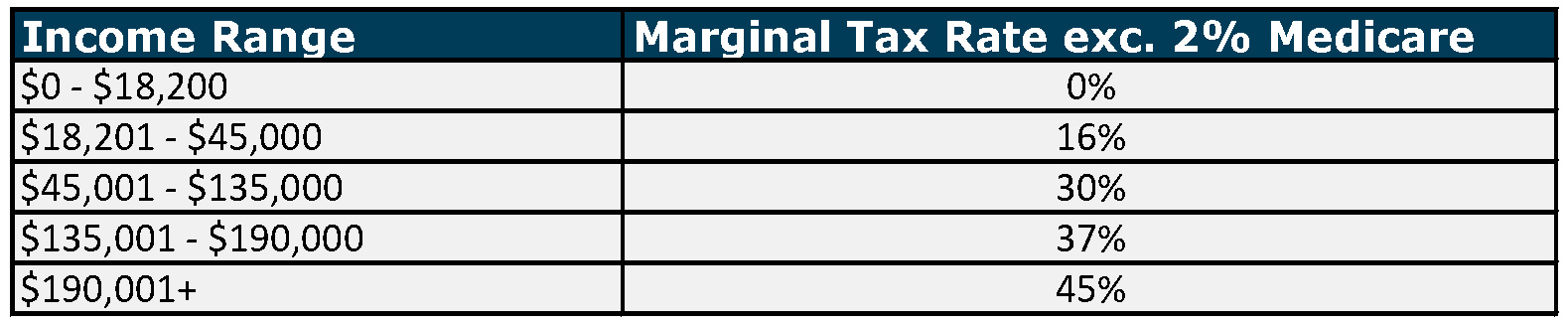

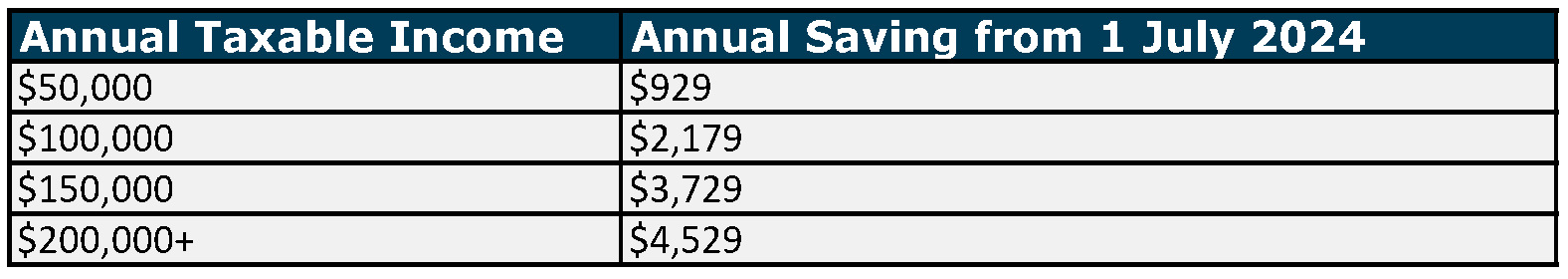

- Stage 3 tax cuts – have already been legislated and will be effective from 1 July 2024. The new taxable income bands annual tax savings are:

- Energy bill relief – all Australian households will receive a $300 rebate on their 2024-25 energy bills. Eligible small businesses will receive $325. The rebates will automatically apply to your bills.

- HECS debts – following the 7.1% indexation of student debt in 2023, more than 3 million Australians will receive a reduction in their HECS debt. The average student will receive an indexation credit of around $1,200 for the past two years. Future indexation will also be capped at the lower of either the Consumer Price Index (CPI) or the Wage Price Index (WPI) with effect from 1 June 2023 (subject to the passage of legislation).

- Sunset on FBT exemptions for plug-in hybrids – the FBT exemption for plug-in hybrid electric cars will cease from 1 April 2025. The exemption will continue for 100% electric vehicles.

- Foreign resident capital gains tax – currently, a foreign or temporary resident for tax purposes can disregard any capital gains or loss when calculating their Australian tax position unless the gain or loss was made from a direct or indirect interest in Australian real property. From 1 July 2025, amendments will apply to capital gains tax (CGT) events to clarify and broaden the types of assets foreign residents are subject to CGT on, which is expected to include anything fixed to the land. These amendments are proposed to align the Australian laws with OECD standards.

Support for Business

- $20,000 instant asset write-off – The Government will extend the instant asset write-off for another year for small businesses with an aggregate annual turnover of less than $10 million that first use or install the asset by 30 June 2025.

- Building and construction support – we need to build more homes in Australia. The government has previously announced a target of 1.2 million new homes by 2030. A range of new Federal Government funding costing $11.3 billion was announced for the States and Territories for housing and infrastructure, as well as initiatives to increase the available skilled workforce for the industry.

Aged Pension

- Freezing social security deeming rates – Social security deeming rates will be frozen at their current levels for another 12 months to 30 June 2025. This measure is to support Age Pensioners and other income support recipients who rely on income from deemed financial investments together with their payment to manage cost of living .

Domestic Violence

- Leaving Violence Program – $925.2 million will go towards permanently establishing the Leaving Violence Program over five years. The program will provide eligible victim-survivors with an individualised support package of up to $1,500 in cash and up to $3,500 in goods and services, plus safety planning, risk assessment and referrals to other essential services for up to 12 weeks.

Other

- Future Made in Australia – a $23 billion initiative seeking to attract and enable long-term private sector investment in renewable energy and create value-add to our resources sectors. Australia’s potential to produce abundant renewable energy is a source of comparative advantage. Five industries have been prioritised for funding:

- Renewable hydrogen

- Critical minerals processing

- Green metals

- Low carbon liquid fuels

- Clean energy manufacturing, including battery and solar panel supply chains.

- Immigration – the government has plans to cut annual migration levels back to 260,000 a year. In 2023 net overseas migration was 548,800.

Contributed by Rick Walker of Lorica Partners, Friend of Alman Partners.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.