The 60-year retirement is not that far away.

Can you imagine living to 120 years of age?

Well, given my tender age of 62, probably not in my lifetime. If you are currently 30 the life expectancy in Australia could easily reach 100 for your generation. Then who knows with technological & medical advancements the generation after may live physically & mentally strong for up to 60 years in retirement.

Average life expectancy has increased over the past five decades by nearly 14 years for men (to 81) and by 11 years for women (to 85).1 The last generation generally retired at age 65 with an average life expectancy for a male at age 67 and females at 71. So clearly the urgency to fund their retirement years was not as urgent as it is now. In less than one generation though we now retire at age 60, on average, and could spend another 20 to 30 years retired.

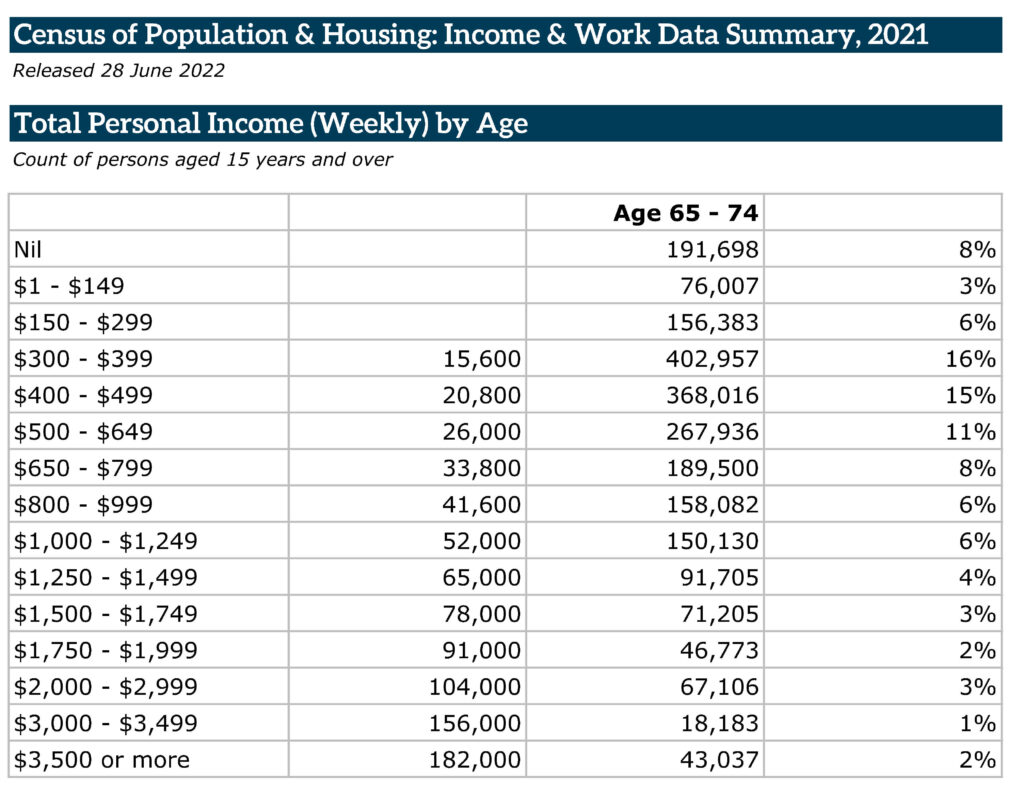

I recently researched the average income of 65 to 74-year-olds from the 2021 census data and the figures are worrying. 48% earned under $26,000 p.a. & only 11% earned over $78,000 p.a. Granted a couple may be earning more, but in many cases, this is not the case. By the way, I am not sure who is earning nil.

More years of living often means more years in retirement. That makes it crucial to be mentally and financially set for life’s next stage. What does increasing longevity mean for your wealth creation & what is your plan to not fall into the same predicament of the 48% of current retirees just making ends meet?

Mentally if you are preparing for retirement, it is incredibly important to also have a plan for this next stage of life. The last thing you want is to be fearful of this exciting next chapter of your story. A great book to assist in this plan is ‘So You Think You Are Ready to Retire’ by Barry LaValley.

In his recent article, ‘How to Avoid a ‘Mid’ Retirement,’ Anthony Isola states growing old and vanishing is an unrelenting nightmare for people. The fear of irrelevancy often trumps the uncertainty accompanying freedom from the workplace.

So, follow these wise words of the poet Dylan Thomas.

Do not go gentle into that good night.

Rage, rage against the dying of the light.

Financially, the first key for success is to start early. Your greatest asset is your human capital (ability to earn income) over your lifetime. Secondly, establishing a well-structured Financial Plan with a trusted adviser to set the framework for allocating a portion of that future cashflow to creating wealth is critical.

1 Australian Institute for Health and Welfare, 1 July 2023

Stephen Lowry (CFP® Professional, DFP, AIF®) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.