As humans, our brains are wired to make emotive/instinctive or logical/rational decisions. In order to make us more efficient, the brain reduces the amount of information it processes to make a decision – thereby reverting to emotive/instinctive decisions. However, our instincts were never really designed for dealing with investment markets.

Letting emotions dictate your investment decisions is a sure way to lose money. People tend to buy at the top and sell at the bottom. BUY ON GREED and SELL ON FEAR! By taking our emotions out of investing, all we need to do is to have a plan, stay disciplined and be willing to give your investments time.

With a process, you are less likely to pursue the uncontrollable or unrepeatable – whether wasting time and money trying to second-guess markets or chasing last year’s winners or switching your investment strategy based on whatever is fashionable at any one moment.

Instead of trying to ride your luck or intuition, you are methodically and steadily following a repeatable and defensible process that your Adviser has designed with your goals, circumstances and preferences at heart.

Ultimately, paying attention to the process makes your destination more achievable.

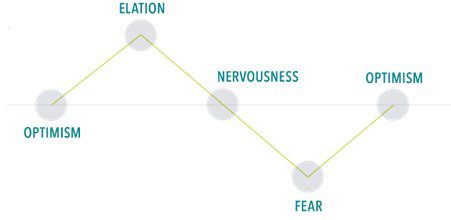

Many people struggle to separate their emotions from investing. Markets go up and down. Reacting to current market conditions may lead to making poor investment decisions.

Avoid Reactive Investing

For investors, it can be easy to feel overwhelmed by the relentless stream of news about markets. Being bombarded with data and headlines presented as affecting your financial well-being can evoke strong emotional responses from even the most experienced investors. Headlines from the so-called lost decade – the 2000s, when the S&P 500 ended below where it began – can help illustrate several periods that may have led market participants to question their approach.

- March 2000:

Nasdaq Stock Exchange Index Reaches an All-Time High of 5048

- April 2000:

In Less Than a Month, Nearly a Trillion Dollars of Stock Value Evaporates

- October 2002:

Nasdaq Hits a Bear-Market Low of 1114

- September 2005:

Home Prices Post Record Gains

- September 2008:

Lehman Files for Bankruptcy, Merrill Is Sold

While these events are more than a decade behind us, they can still serve as an important reminder for investors. For many, feelings of elation or despair can accompany headlines like these. We should remember that markets can be volatile and recognise that, in the moment, doing nothing may feel paralysing. However, if one had hypothetically invested $10,000 in US stocks in January 2000 and stayed invested, that would be worth approximately $38,400 at the end of 2020.1

When faced with short-term noise, it is easy to lose sight of the potential long-term benefits of staying invested. While no one has a crystal ball, adopting a long-term perspective can help change how investors view market volatility and help them look beyond the headlines.

Having a strong relationship with an Adviser can help you be better prepared to live your life through the ups and downs of the market. That’s the value of discipline, perspective, and calm. That’s the difference the right Financial Adviser makes.

Footnotes

- As measured by the S&P 500 Index. A hypothetical portfolio of $10,000 invested on January 1, 2000, and tracking the S&P 500 Index, would have grown to $38,387 on December 31, 2020. However, performance of a hypothetical investment does not reflect transaction costs, taxes, or returns that any investor actually attained and may not reflect the true costs, including management fees, of an actual portfolio. Changes in any assumption may have a material impact on the hypothetical returns presented. It is not possible to invest directly in an index.

Jason Kirk (CFP® Professional, SMSF Specialist Adviser, GradDip. App.Fin&Inv, B.Econ) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.