In many areas of life, intense activity and constant monitoring of results represent the path to success. In investment, that approach gets turned on its head.

The Chinese philosophy of Taoism has a word for it: “Wuwei”. It literally means “non-doing”. In other words, the busier we are with our long-term investments and the more we tinker, the less likely we are to get good results.

That doesn’t mean, by the way, that we should do nothing whatsoever. But it does mean that the culture of “busyness” and chasing returns frequently promoted by much of the financial services industry and media can work against our interests.

Investment is one area where constant activity and a sense of control are not well correlated. Look at the person who is forever monitoring their portfolio, who fitfully watches business TV or who sits up at night looking for stock tips on social media. Other than high anxiety, many distractions and a waste of time, what do they achieve?

In Taoism, by contrast, the student is taught to let go of factors over which they have no control and instead go with the flow. When you plant a tree, you choose a sunny spot with good soil and water. Apart from regular pruning, you leave the tree to grow.

But it’s not just Chinese philosophy that cautions us against “busyness”. Financial science and experience show that our investment efforts are best directed to areas where we can make a difference and away from things we can’t control.

So we can’t control movements in the market. We can’t control news. We have no say over the historical headlines that constantly distract us.

But each of us can control how much risk we take. We can diversify those risks across different assets, companies, sectors and countries. We do have a say in the fees we pay. We can influence transaction costs. And we can exercise discipline when our emotional impulses threaten to blow us off course.

We can also control how much we keep invested in cash and fixed interest, being ‘risk dampeners’ to protect ourselves from the risk of needing to sell part of our share portfolio at distressed prices to meet our cash flow needs.

The reason these principles are so hard for people to absorb is that the perception of investment promoted through the financial media is geared around the short-term, recent past, the momentary, the narrowly focused and the quick fix. Furthermore, anxiety is advantageous for advertisers and the ‘selling’ or ‘historical’ news by media, but a distraction and exceedingly disadvantageous to the reader.

We are told that if we put in more effort on the external factors, that if we pay closer attention to the day-to-day noise, we will get better results.

What’s more, we are programmed to focus on idiosyncratic risks, like glamour stocks, instead of systematic risks such as the degree to which our portfolios are tilted toward the broad dimensions of risk and return.

Ultimately, we are pushed towards fads that the financial marketing industry decides are sellable and which require us to constantly tinker with our portfolios.

Much of the media and financial services industry wants us to be busy, but about the wrong things. The emphasis is often on the excitement induced by constant activity and chasing past returns rather than focusing on the desired end result, (maybe some people are starting to realise this. In the US, the Fox Business Network and CNBC ratings are down 19% and 13% respectively in 2013 despite the US stock market being up 16% for the year to date1).

The consequence of all this busyness, lack of diversification, poor timing decisions and narrow focus is that most individual investors earn poor long-term returns. In fact, they tend not to even earn the returns available to them from a simple index.

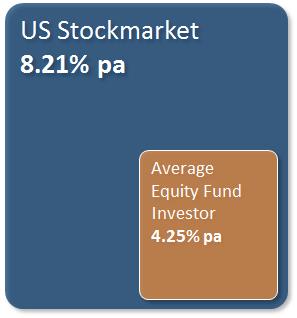

This is borne out each year in the analysis of investor behaviour by research group Dalbar. In the 20 years to December 2012, for instance, Dalbar found that the average US managed fund investor underperformed the overall market by nearly 4.0% per annum2:

This documented difference between simple index returns and what investors receive is often due to the individual behaviour – in being insufficiently diversified, in chasing returns, in making bad timing decisions and in trying to “beat” the market by unwittingly buying ‘high’ and selling ‘low.’

The net result is that after 20 years, their share portfolio is worth 53% less than a simple market portfolio.

In other words, your behaviour will have a far greater impact on your investment returns than the performance of the funds in your portfolio. That is part of our role working with clients – to put strategies in place to help them feel comfortable that they can remain disciplined and think long term when markets are tempestuous.

Recently, one of Australia’s most frequently quoted analysts broke ranks from the industry and gave the game away on this “busy” investing. In his final note to clients before retiring to consultancy work, Morgan Stanley strategist Gerard Minack said he had found over the years that investors were often their worst enemies3.

“The biggest problem appears to be that, despite all the disclaimers, retail flows assume that past performance is a good guide to future outcomes,” Minack said.

Consequently, money tends to flow to investments that have done well, rather than investments that will do well. The net result is that the actual returns to investors fall well short not just of benchmark returns, but the returns generated by professional investors. “And that keeps people like me employed.”

It’s a frank admission and one that reinforces the ancient Chinese wisdom: “By letting it go, it all gets done. The world is won by those who let it go. But when you try and try, the world is beyond the winning.”

1 CNBC Ratings Prove Investors Just Don’t Care, The Slant, 29 May 2013.

2 Quantitative Analysis of Investor Behavior, Dalbar, 2013.

3 Downunder Daily, Gerard Minack, Morgan Stanley, May 16, 2013.

Stephen Lowry CFP, DFP, FAIM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.