“I can calculate the motion of heavenly bodies, but not the madness of people”

Sir Isaac Newton, 1720. All humans have inbuilt biases when making investment decisions – they have evolved over time as part of our survival instincts. Unfortunately, many of these behavioural biases are completely opposed to the systematic approach one should adopt for the ongoing management of investments.

The major behavioural biases that can work against us having a positive investment experience are:

1. Overconfidence bias

Most people think they are smarter than others, meaning their portfolio will undoubtedly perform better than most.

2. Hindsight bias

Rises and falls in markets appear obvious after the fact, therefore many think the future must also be predictable.

3. Familiarity bias

Only investing in securities we ‘understand’ or ‘know’ can breed a false sense of control over our investments and lead to highly concentrated portfolios. Unfortunately, the market doesn’t reward investors for familiarity.

4. Regret Aversion bias

Not allowing ourselves to make the same mistake again. If we lost money in bank stocks in late 2008, we may decide never to buy bank stocks again.

5. Self-attribution bias

We give ourselves credit for being smart when successful, but attribute failures to externalities beyond our control.

6. Extrapolation

We rely too heavily on recent facts to make decisions on our future, or only pay attention to data that supports our bias and ignore data that refutes it. So when markets fall, we think markets will continue to fall and therefore avoid entering markets, even though the expected rate of return of stocks has increased. So many investors do the opposite of what they should do.

There are valid human reasons for us to have these inherent biases, but when it comes to investing, these biases can be problematic. When faced with risky decisions, the typical human reaction is to allow emotion to overwhelm reason.

We therefore need a systematic and disciplined investment approach and plan to control emotions. This often requires discussing potentially emotive decisions with an objective and impartial expert.

“At the end of our investing lifetime, it won’t matter what your funds did, it will matter what you did. And what you did will be a pure function of the quality of advice you received – from one caring, competent adviser and not from any number of magazines”

Nick Murray, Investment Adviser Magazine, October 1994

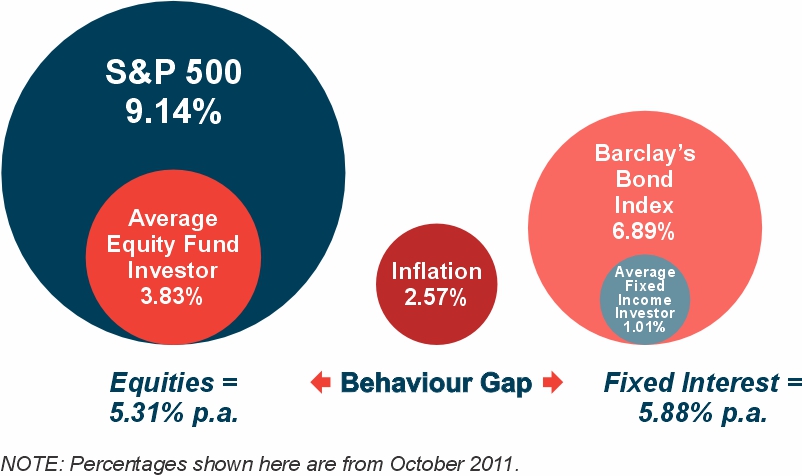

And here’s the evidence of what happens when we don’t control these biases.

Dalbar provides independent research in the US financial services industry. In 2010, when the S&P 500 index rose 15.06%, Dalbar estimated the average US investor only received 13.60% – or 10% less.

Over the longer term, Dalbar has analysed the average market return for equity investors compared to the S&P 500 index and for fixed interest investors compared to the Barclays Bond Index. The annual results over the 20 year period to 31 December 2010 are shown below:

After 20 years, the average equity investor has succumbed to their behavioural biases to market time (buy high and sell low) and stock pick. This behaviour has cost them on average 5.31% pa, resulting in a portfolio worth 63% less than the market portfolio over 20 years. Their performance has only just outperformed inflation.

The results were similar for the average fixed interest investors, where the behaviour gap has cost on average 5.88% pa. At the end of 20 years, the average fixed interest portfolio is worth 68% less than the market portfolio. In addition, their investments failed to keep pace with inflation, meaning the purchasing power of their money went backwards.

Investment returns are more dependent on investor behaviour than fund performance. Patient and disciplined investors typically earn higher returns over time than those who attempt to time the market or do not have diversified portfolios.

So why do investors try? There is no doubt that if you could successfully time markets it would make you rich. But no one has the ability to consistently do this successfully without a significant amount of luck, so why try? Winning lotto can also make you rich, but hopefully nobody spends the majority of their income buying lotto tickets.

Trying to time markets to ‘win’ can give investors a buzz, but it’s speculating, notinvesting.

“Investing should be dull. It shouldn’t be exciting. If you want excitement, take $800 and go to Las Vegas”

Paul Samuelson, 1970 Nobel Laureate in Economics

And the media generally isn’t interested in controlling your biases – it feeds off them. The media is paid by advertisers – they are not rewarded by whether you make money or not.

“You make more money selling advice than following it. It’s one of the things we count on in the magazine business – along with the short memory of our readers”

Steve Forbes, Publisher, Forbes Magazine, Presentation to UCLA, 15 April 2003

At times investors may consider our Asset Class investment philosophy unexciting, or at times static. But at its core, this philosophy is designed to overcome behavioural biases and use evidence and discipline to maximise the probability that our client’s achieve their objectives.

We focus on the outcome and a ‘peace of mind’ experience along the way – and it has proven to work.

If investors can afford to have some fun along the way and wish to speculate with a portion of their portfolio, there is nothing wrong with this approach, so long as they understand this is not investment and that the core of their portfolio remains invested in accordance with a strategy and risk profile designed to achieve their longer term goals and objectives.

Our goal is to ensure that our clients capture the asset class market returns in the most cost and tax effective way.

We acknowledge and thank Scott Bosworth from DFA for his input to this article

Stephen Lowry CFP, DFP, AIMM, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107. This information is of a general nature and is not intended as personal advice. Readers should seek professional qualified advice before making any investment decisions.