Happy Financial Year to All. Now that we are into the 2018/19 financial year, this means that the recent approval from the Senate of the seven-year Personal Income Tax Plan comes into effect, and you may find yourself with some loose change in your pocket! The first step of this plan is to provide small tax relief to low and middle-income earners.

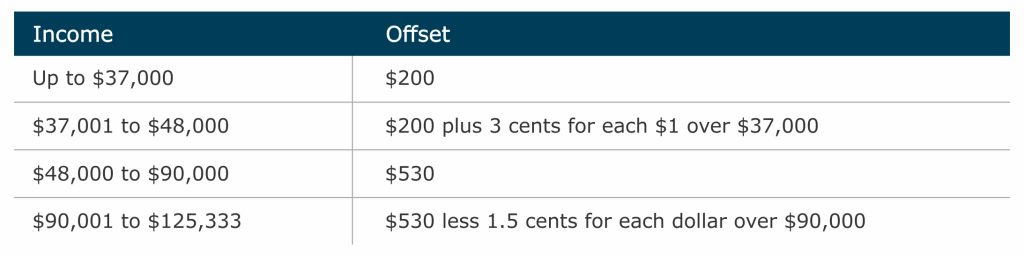

This will see a tax offset of up to $530 to low and middle-income earners which earn up to $90,000. This offset will be available upon lodging your tax return.

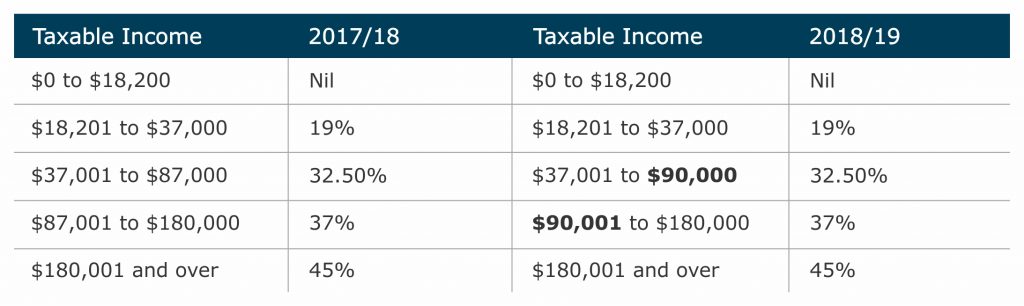

We will also see an uplift to the 32.5% ceiling from $87,000 to $90,000 as outlined below: Anyone earning over $90,000 per annum will be eligible for a tax saving of $135 for the year due to this change.

Anyone earning over $90,000 per annum will be eligible for a tax saving of $135 for the year due to this change.

The 2nd step in the tax plan is to expand tax relief to middle-income earners. From 1st July 2022, the top threshold of the 32.5% tax bracket will be increased from $90,000 to $120,000, providing a tax cut of up to $1,350 per year.

The 3rd step is to simplify the tax system. From the 1st of July, 2024, the Government will increase the top threshold of the 32.5% bracket from $120,000 to $200,000, abolishing the 37% tax bracket. This will be a tax saving of $2,025 for a single household income of $120,000.

The Government have released figures showing that out of every 20 taxpayers, there are 4 taxpayers in the 37% tax bracket v’s 10 taxpayers in the 32.5% tax bracket. The Government projects in seven years that, by abolishing the 37% tax bracket, they will see the majority of taxpayers, around 15 out of 20, in the 32.5% tax bracket.

This plan ensures that the minority is not taking the majority of the tax burden and encourages the tax system to not act as a drag on growth and aspiration. Talk to our financial advisers for more information about this article.

Frances Easton CFP, M.FinPlan, B.Bus Acc, is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Reference: https://www.budget.gov.au/2018-19/content/individuals.html

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.