Prioritising Goals Over Market Performance: The True Measure of Financial Success

Why are you working, saving and investing?

I highly doubt you said, “So I can beat the All Ordinaries index.” What you probably said was something like, “So I can send my kids to university,” or “So I can retire early,” or “So I can take a trip around the world.” And yet some investors’ actions seem to suggest they’re focused on something else: beating the market.

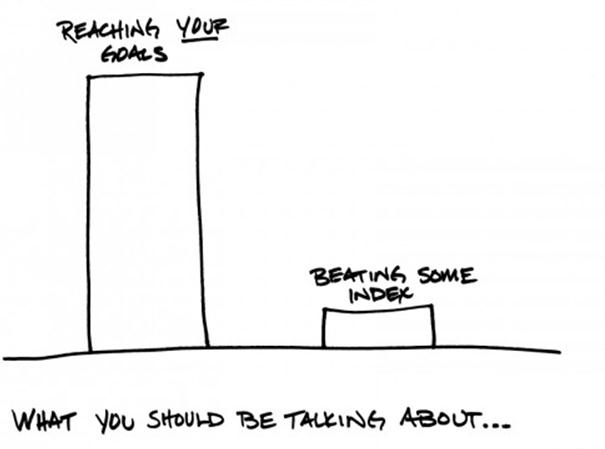

Does it really matter more if you beat a particular index than if you reach your goals? If you happen to accomplish it while reaching your goals, good for you, but beating the market isn’t the kind of goal that matters.

While we are on the subject of focusing on what really matters I personally believe the drive to ‘Self Manage’ Superannuation funds for most is detrimental in many cases to achieving their most important goals.

The Costly Pursuit of Trying to Beating the Market

Back to markets, if we make beating the market our primary focus, it becomes incredibly difficult to behave. Instead of working towards something tangible that aligns with our values, we try to outguess what the market will do next. And that’s the kind of behaviour that can hurt our goals the most.

In some ways, I suspect very few of us can afford to attempt to “beat the market” because it is a costly exercise. It is costly because research shows 70% of professional fund managers cannot beat the market so how can the average punter?

So when you’re tempted to play the game, I suggest you line up your most important goals and keep focused on what is important. Achieving the markets average return will move you closer to achieving them.

1 S&P Indices Versus Active Funds (SPIVA) Report – 30 June 2022; S&P/ASX 200 82.93% of Managers who underperformed the Index.

Stephen Lowry (CFP® Professional, DFP, AIF®) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Note: Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.