After much anticipation and media speculation, on March the 16th the US Federal Reserve raised its Federal Funds target interest rate from a range of 0-0.25% to the range of 0.25-0.5%. The Fed had kept its benchmark rate steady after delivering a full percentage-point cut in March 2020 amid the start of the coronavirus pandemic.

The Fed has been flagging the start of rate hikes for the last six months and started signaling that the first hike would happen at the March meeting early this year after inflation indicators kept rising. While the conflict in Ukraine added to uncertainty around the move, the 0.25% increase was fully factored into financial markets. In fact, US shares rose on positive Fed comments around employment and economic growth.

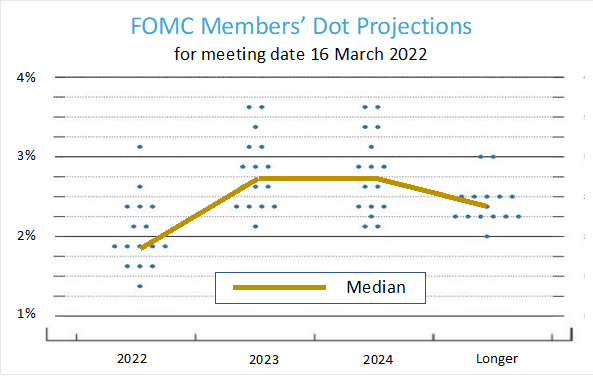

The U.S. central bank signals its outlook for the path of interest rates with a “dot plot”, which shows how the Committee Members of the Fed – formally the Federal Open Market Committee (FOMC) – view appropriate monetary policy. The Dot Plot below shows officials expect to raise the Fed Funds rate six more times this year, based on median projections.

In the US inflation is at a 40-year high (core inflation is at 6.4% yoy) and the conflict in Ukraine has created additional upward pressure on inflation, particularly by higher energy prices. Nonetheless, the Fed reiterated that some of the inflationary pressures were related to supply and demand imbalances related to the pandemic, and they expected inflation to be at their target rate of around 2% in the longer term.

Against the inflation background, economic activity has recovered and continues to strengthen and the labour market is very tight with unemployment at 3.8%. The Fed also signalled that it will likely start Quantitative Tightening by not replacing the maturing bonds that were bought as part of the Quantitative Easing program.

Implications for global markets

The fall in stock markets since the start of the year can be attributed to market expectations around future increases in interest rates (linked to the continuing rise in inflation indicators), coupled with the uncertainty caused by the conflict in Ukraine which began in February. As noted above the rise in the stock market after the announcement implies that the market had fully priced in the 0.25% increase, and were buoyed by the Fed’s comments in relation to the health of the economy.

The Dot Plot also reaffirms that the likely path of interest rate rises will still be relatively modest, with the longer-term mean at just under 2.5%. This is consistent with the market expectations. While economic conditions can unexpectantly change, most market participants are not expecting inflation or interest rates to rise dramatically.

While there is little reason to be too concerned by the first US rate hike, there are two main risks to expected returns from the stock market: 1) Inflation pressures are far more significant than anticipated and this may necessitate an even faster tightening in monetary policy than in the past; and 2) The war in Ukraine increases uncertainty and poses a threat of weaker global growth – notably in Europe.

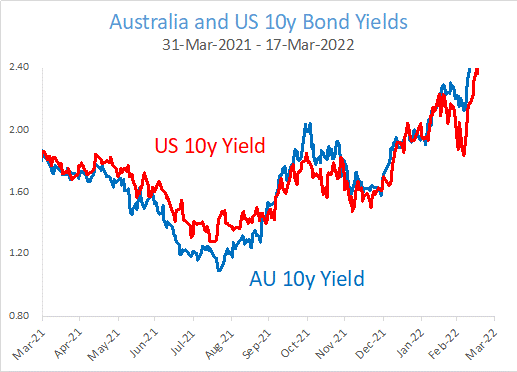

The bond market seems to be looking through the second factor, as there is no sign of a “flight to safety” in long bond yields. Consistent with the Dot Plot, the 10y yields in the US (and Australia) are still under 2.5%.

In summary, while the Fed’s move to raise rates is consistent with volatile and constrained share market returns ahead, it does not imply a bear market as monetary policy is far from tight and unlikely to drive a US recession.

Implications for Australian investors

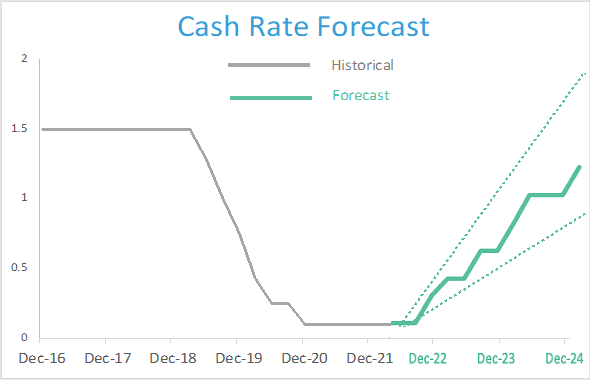

The RBA will soon follow the Fed in starting to raise interest rates. However, Australian interest rates are likely to rise less than US interest rates reflecting lower inflation in Australia and the start of a downturn in Australian property prices which will dampen the pressure to raise rates much. Underlying inflation is expected to increase in coming quarters to around 3.25%, before declining to around 2.75% in 2023.

The unemployment rate is projected to fall to below 4% later in the year and to stay below 4% in 2023. However, wages growth – an important input into inflation – is expected to stay modest. At the March meeting, the Board reiterated that it was prepared to be patient and would not increase the cash rate until actual inflation is sustainably within the 2 to 3% target range.

While a decline in the short-term interest rate gap between Australia and the US normally puts downwards pressure on the value of the $A this is likely to be more than offset by strong commodity prices which is being accentuated by the war in Ukraine. As a result, the negative interest rate differential should not have a material effect on the A$.

What matters for individual investors is whether they are on track to meet their own long-term goals detailed in the plan designed for them. Uncertainties around interest rates, inflation and geopolitical events will cause market volatility, which can be worrisome to investors. The best approach for investors is to accept market volatility and to stay disciplined, diversified, and keep focused on progress to your goals.

Dr Steve Garth (PhD (AppMaths), BSc (MathsPhys), BA (Majoring in History & Politics), MAppFin, GradDipBusAdmin) is an Independent Member of Alman Partners’ Investment Committee.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.