Progress is rarely linear. It is a significant statement, but it’s worth pondering over a moment. It does not matter which area of life we are talking about – improving fitness, sticking to healthier eating habits, reducing time on social media, improving reading habits, the list goes on. The path towards a long-term goal is characterised by ups and downs along the way but so long as the journey is forward and upwards, we are winning!

What about investing?

Investing is no different. If anything, the investment journey – the ups and downs are prominently displayed via the instant and constant market updates, and the markets are never linear! The temptation to act to do something based on the short (and the near) term movements is very strong. While it may pose a challenge for some to resist focusing on the day-to-day movements of the market, for those who choose to not focus on the short-term, the investment journey is likely to be more comfortable.

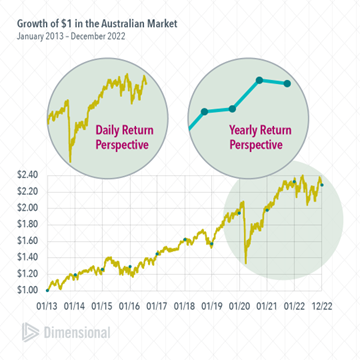

As an example, the Australian Share market more than doubled in value in the 10 years ending December 2022 but also suffered intraday losses of at least 1% on 242 occasions over these 10 years. To benefit from the long-term return, you needed to remain invested in the market – on the good and the bad days!

The long-term, or even the end-of-year returns, does in no way mean that the investors avoid volatility, it just means that the short-term market downturns are less noticeable.

The graph below shows – the role of perspective. The first circle focuses on daily returns from 2020 until 2022 and the volatility the daily movements bring, however changing that over to yearly returns smoothens the peaks and the troughs. However, the minute we look at the 10-year return – all one can see is that despite the zig and the zag in returns – the journey is upward!

As it is for someone looking to lose some weight or get fitter, short-term temptations and distractions are easier to manage if they keep bringing their long-term goals to the forefront.

Source: DFA article “Perspective Matters by Warwick Schneller”, PhD, CFA, Senior Investment Strategist and Vice President

Niyati Khanna (CFP® Professional, CA, MBA [Finance & Strategy]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Any information provided to you was purely factual in nature. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.