The Alman Partners Team have been reading a book called “Living and Leading with Heart, Above the Line” written by Stephen and Mara Klemich.

We highly recommend this book if you are looking for a good read and a reflection on your own behaviours and why we act the way we do.

The book talks about templates, triggers and truths that are formulated by past experiences.

Situation + Thinking = Behaviour

Triggers

Templates

Truths

These templates, triggers and truths can see us go “below the line” with our behaviour displaying self-pride or self-protection or can also see us “above the line” with love or humility.

The book gives an example of 2 people, Jack and Jill who while out for a walk in the park come across a Dog. Jack believes dogs bite, so he is scared and turns to go away, whilst Jill believes the dog must be lost and so she must help the dog and gives it a pat. Even though they are in the same situation and environment they have behaved differently based on their past experience (Templates). Similarly, each of us has a different context based on our past experiences and our truths formed from these past experiences.

This relates to every aspect of our lives and certainly, this also relates to money in how we behave and react to certain situations when money decisions are involved. What are the truths, triggers and templates that you have developed based on your experiences around money?

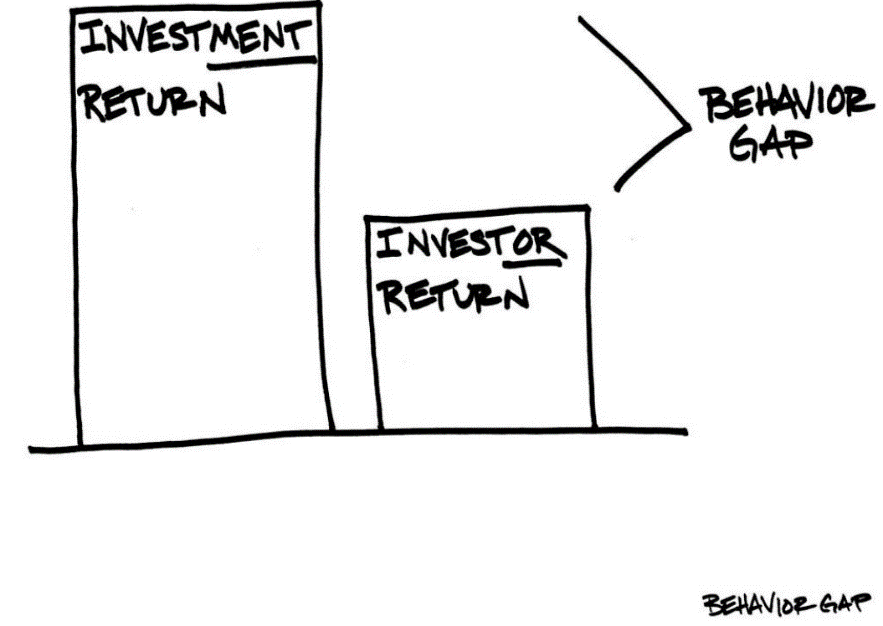

Behaviours can play a big part in impacting one’s financial well-being and in turn, their overall life experiences, as Carl Richards illustrates simply.

There are many behaviours around money, here are a few examples:-

- Behaviours of procrastination or not actioning an investment could perhaps be a fear of regret. Maybe you want to wait for the best investment or the best time to invest. Or perhaps a past not so successful investment decision has made you fearful of repeating the same mistake?

- Do you avoid having conversations about money with your partner/family as you have experienced or observed past situations in which talking about money did not end well?

- Maybe you have had a great past investment experience and now consider that this will be the case no matter what you invest in, you believe you have all the answers or you can time markets and/or pick stocks.

Can you identify the “below the line” behaviours in these above cases?

Stephen and Mara, suggest asking yourself a number of questions to give yourself insight and assist you to transform to above the line behaviours.

- While resisting a blaming mindset, can you identify the trigger or template that drove you below the line? What needs to happen for you to go below the line?

- Is there a truth attached to how you were thinking and behaving?

- What were you trying to achieve? What was its purpose?

- Can you think of another time when you behaved similarly?

- What is one step you could take differently the next time a similar situation or trigger pops up?

We are emotional beings and to operate above the line requires hard work, self-reflection and much personal discovery. I’m no expert when it comes to living above the line 100% of the time and I’m yet to meet anyone who can, but I know from personal experience it is much more enjoyable operating with the intent of Living Above the Line and following this through with the behaviours that demonstrate this. Also, it allows me to understand why certain people around me behave in certain situations and helps me to continue to work towards being “Above the Line” by understanding their truths.

I also appreciate the honesty and open conversations that clients have with us around past experiences with money and how they feel when triggered by certain situations. This information is so important to ensure that we provide the most appropriate advice but also to help you manage these behaviours in certain situations around the advice process.

We hope you enjoy the book recommendation and next time you meet with your financial adviser consider having a chat over a coffee as to your triggers, templates and truths around money.

Klemich, Stephen & Mara, 2020, living and leading with heart Above the Line, https://heartstyles.com/book

Richards, Carl, Behaviour Gap https://behaviorgap.com/

Frances Easton (CFP® Professional, MFinP, BBus-Acc,) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person or entity. Accordingly, to the extent that this material may constitute general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. This is not an offer or recommendation to buy or sell securities or other financial products, nor a solicitation for deposits or other business, whether directly or indirectly.