It was a beautiful winter afternoon in Mackay. The sun was warm as I watched my 4- and 8-year-old race around on their bikes. My youngest, determined to beat her big brother, pushed with all her might on her little balance bike. I cheered, gave her a head start, even asked her brother to slow down – but she still couldn’t win. Frustration set in for her, while her brother grew increasingly proud of his easy victories.

This scene reminded me of a recent conversation about portfolio returns. A friend shared his portfolio performance with great enthusiasm, comparing it with another friend’s portfolio. But here’s the thing: comparing returns without context is like comparing my 4-year-old on a balance bike to my 8-year-old on a bicycle.

Both kids are “in the race,” just as both portfolios are “in the market.” But the balance bike—like a portfolio with defensive assets—is designed for stability and safety, and adequate speed to make it fun and interesting. Its purpose is to teach balance and reduce risk, much like defensive assets in a portfolio – they provide liquidity and dampen volatility, often reducing overall expected return over the long term. The bicycle, on the other hand, is built for speed and adventure – just like a portfolio fully invested in growth assets such as shares and property. It can deliver higher returns, but with greater volatility and risk.

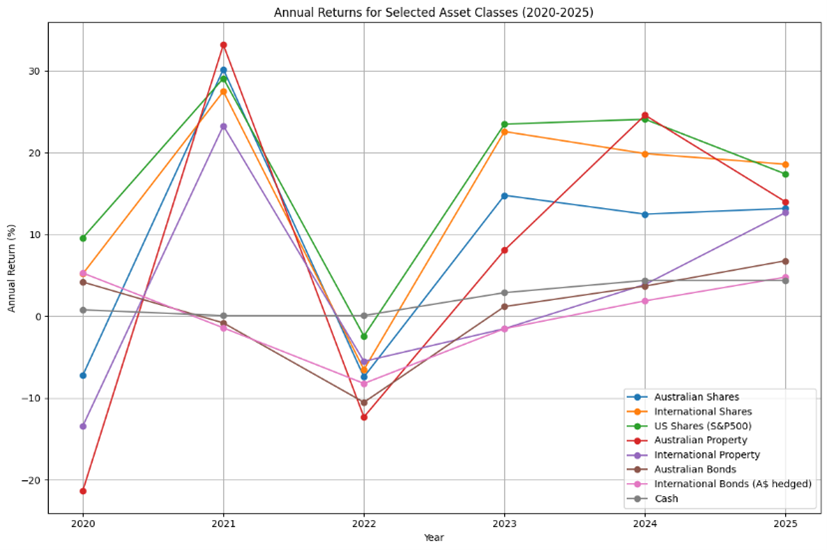

For example, Australian property returned -21.3% in 2020 (COVID impact) and then +33.2% in 2021 (recovery). Australian shares also experienced sharp declines and strong rebounds. These swings highlight why comparing portfolios without considering asset allocation is misleading and may take you away from your path to getting your financial house in order and keeping it that way!

Annual Asset Class Returns (2020 – 2025)

So, next time you hear someone boast about returns, remember: you might be comparing a push bike to a racing bicycle. The tools, terrain, and purpose matter just as much as the speed. If you’re unsure whether your portfolio matches your goals and risk tolerance, speak to your financial adviser.

Niyati Khanna (CFP® Professional, CA, MBA [Finance & Strategy]) is a representative of Alman Partners Pty Ltd, Australian Financial Services Licence No: 222107.

Performance data shown represents past performance or simulated performance. Past performance is no guarantee of future results and current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Note: This material is provided for GENERAL INFORMATION ONLY. It has not been taken into account your personal objectives, situation or needs. The information is objectively ascertainable and is not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001 (Cth). It is recommended that you obtain financial product advice before making any decision on a financial product such as a decision to purchase or invest in a financial product. Please contact us if you would like to obtain financial product advice.