Comprehensive Financial Planning Mackay & Brisbane

Comprehensive Financial Advice

Comprehensive Financial Planning starts with understanding what your most important goals are based on your deepest-held values. After all, building wealth is all about the choice to do the things you want to do with the people that are most important to you in your life, we call that True Wealth.

The next step is building a plan to get there. That is going to require an in-depth analysis of each area of your finances. This gives us a clear understanding of your current situation and insight into your future goals and aspirations. With this detailed information, we are then able to create a holistic plan that will cover every area of your financial life, highlighting items that need improvement and outlining a path to achieve your True Wealth, whatever that may be.

Our process is designed to ensure we have all the relevant information and we understand your situation fully, and you understand the

the advice we are proposing prior to implementing.

Here’s our advice journey that you will undertake.

Along with providing quality advice, our Advisers will provide you with confidence in your financial journey, providing you with peace of mind in your financial situation.

Financial Advice is so much more than a Financial Plan.

Frequently Asked Questions about our Financial Planning

COMPREHENSIVE FINANCIAL ADVICE

We believe all Australians should seek Comprehensive Financial Advice. But due to cost or lack of access, it is not always a viable option for everyone. Alman Partners’ Comprehensive Financial Planning is ideal for those with complex financial situations, time-poor professionals, those with minimal debt and a high level of investible assets or those wanting direction on their journey to True Wealth. If you are unsure if this is you, contact our office to discuss your situation with our experienced team.

A fiduciary financial adviser is an individual who has responsibility for the management of the assets of others. This places them in a special position of confidence, reliance, and trust. Fiduciaries are required to act in the best interests of those they serve and to avoid or properly manage conflicts of interest, whilst maintaining the highest standards.

As an independent firm, we are not licensed through financial product providers, which allows our firm the objectivity to select the most appropriate solutions available market-wide. Holding our own Financial Services Licence (AFSL) gives us greater capacity to put our clients first, effectively removing potential conflicts of interest.

Alman Partners is audited annually by the Centre for Fiduciary Excellence to ensure the highest standards are maintained.

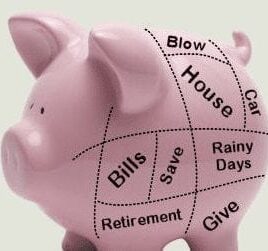

An individual’s financial situation can be quite complex, with one area affecting another without even realising it. Think of a puzzle without all the pieces in place, you can’t see the whole picture. Without gaining a complete understanding of your situation one area of your finances may inadvertently be affected by changes to another. Once you have a well-thought-out and documented financial plan the key then is to stick to it, review progress and make any changes that may be required. It is really a life-long journey.

At Alman Partners we do not provide stand-alone advice on any one individual area of your finances. Rather, we are a holistic advice firm providing financial planning solutions across key areas, where relevant to your individual circumstances.

Investment

There is so much noise around investing and so many options it can be very confusing, but ultimately there are 3 areas where you can invest – Shares, Property & Cash.

Alman Partners delivers World-Class Investment Advice to our many clients. Our approach is Evidence-Based. We do not try and pick stocks or try to time the market. Rather our recommendations are based on Nobel-Prize-winning academic research, not speculation or forecasts. This ensures your portfolio is optimised to capture market returns, giving you confidence that no matter what happens in the markets, the economy or the world you have a high probability of achieving your most important goals. We call this a ‘sleep at night’ portfolio.

We will work with you to develop clear and effective long-term investment strategies whilst considering:

- Any Existing Investments

- Asset Allocation

- Diversification across Asset Classes

- Your Risk Tolerance

Our highly qualified financial advisers will guide you through your investment experience, providing education along the way on how markets work, including inevitable volatility and the emotions that associate with this.

When you first sign on with our firm, you will complete a Risk Tolerance Questionnaire, providing insight into how much risk you are willing to accept within your investments. Combined with our analysis of your current situation, we will recommend a model portfolio based on an appropriate asset allocation, broadly diversified across the asset classes. We are also extremely mindful to reduce the costs of products we might recommend and reducing taxes.

Investing is not reserved for the wealthy, however, due to the costs involved with professional advice, it may not be suitable for all. You can invest minimal amounts via different vehicles, however. For those starting out on their investment journey, you could purchase low-priced stocks, deposit small amounts into an interest-bearing savings account, or save until you accumulate a target amount to invest into an investment platform such as our AP Direct Invest.

The goal of Active Investing is to “beat the index” by actively managing the investment portfolio and trading often. These investors/fund managers believe in market timing and security selection. Few fund managers beat the benchmarks consistently enough to justify the higher costs of active management.

Passive Investing, on the other hand, advocates a passive approach and adopts a buy-and-hold strategy with the understanding that it is difficult to beat the market consistently. This can lead to a more cost-effective investment. Many believe in being able to time the market.

Many Financial Advisers and stockbrokers have the belief that they cannot time markets but can however select the right stock.

Alman Partners takes another approach, taking the informative route that most academics and institutional investors take, believing neither in timing markets nor security selection, but rather relying on academic research and the belief that markets are efficient.

SUPERANNUATION

The Australian Superannuation system is a tax-effective savings vehicle designed to ensure you have an income in retirement (along with personal savings and if required, a Government Pension). It is compulsory for most employers to pay super to their workers, referred to as the Superannuation Guarantee Contribution (SGC). These funds are generally only accessible once an individual has reached their Preservation Age. Ensuring your super is optimising returns early on is important.

Superannuation can be quite complex. There are many things to consider but there are steps you can take to help boost your savings. One area that is often overlooked is the investment option and the underlying asset allocation, with many still sitting on ‘default.’ To understand which investment option is right for your circumstances while considering contributions, caps, taxes, age till retirement and legislation changes, talk to our experienced Financial Advisers to get your super working for you.

If you’re thinking of starting a Self-Managed Superannuation Fund (SMSF), or maybe you already have one, our experienced and professional SMSF advisers are here to help.

A decision to commence an SMSF should not be taken lightly, and you will need to understand if it is appropriate for you based on your individual circumstances, your goals and your objectives. In collaboration with your Accountant, we will strategise and construct the most suitable investment options for your situation.

- Salary Sacrificing

- Co-Contributions

- Spouse Contributions

- Self-Managed Superannuation

- First Home-Owners Super Scheme

- Non-Concessional Contributions

- Small Business Retirement Exemptions

- Tax-Free Pension Payments

Having an expert financial adviser on board will help you navigate the many areas of superannuation and the ever-changing legislative landscape.

Get Started Today

Complete the form below or call our office for more information or book an appointment

"*" indicates required fields

Lead

Educate

Inspire

“Financial Education is more valuable than money”

- Mac Duke